Companies that provide farmers with more environmentally friendly agricultural techniques, such as allowing them to reduce the use of pesticides, are expanding in Brazil. According to the 2023 Agtech Radar Report by the Brazilian Agricultural Research Corporation (EMBRAPA), the number of startups related to biodiversity and sustainability increased from 37 to 83 over the previous year (see Pesquisa FAPESP issue nº 325), while the number working in biological control and integrated pest management rose from 36 to 45, and food safety and traceability grew from 13 to 21.

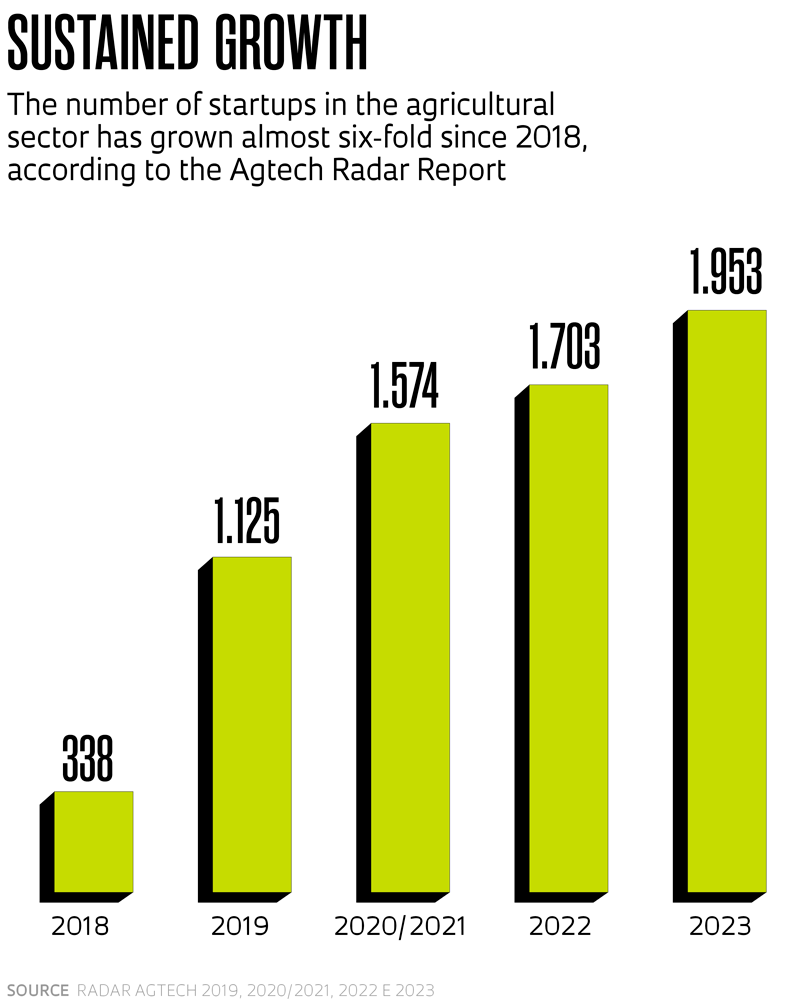

“There is a global trend toward practices that encourage sustainability and environmental conservation,” says EMBRAPA’s business manager Cleidson Dias, coordinator of the annual report. Published at the end of 2023, the latest version identified 1,953 technology companies in the agriculture sector, known as agtechs. There were 250 new companies registered in the past year, an increase of 14.7% over 2022.

“Brazil has seen continuous growth in agtechs, despite difficulties obtaining funding, something that is occurring worldwide,” says mechanical engineer Felipe Guth, a partner at the investment fund SP Ventures, which helped produce the 2023 Agtech Radar together with EMBRABA.

Agtechs in Latin America received US$1.7 billion of investment in 2022, 39% less than in 2021, according to the “Latin America AgriFoodTech Investment Report 2023” report by SP Ventures and AgFunder, an American venture capital firm. The drop recorded in 2022, Guth explains, was caused by changes in the global macroeconomy and repeated waves of the COVID-19 pandemic, which affected investments in startups across all sectors. According to the document, which was cited in EMBRAPA’s report, 45% of investment in 2022 went to Brazil, equivalent to US$765 million.

One startup working in biological control is Gânica, founded in Piracicaba, São Paulo State, in 2015, which intends to launch two products this year. The first is a new strain of the bacteria Bacillus amyloliquefaciens, which according to tests conducted by the company, is capable of reducing leaf spots caused by fungi in soy, maize, cotton, beans, and other plants by up to 80%, representing a new means of sustainably managing diseases in agricultural crops.

The second uses the bacteria Priestia megaterium, which was tested with help from Fernando Andreote, a researcher and professor at the Luiz de Queiroz College of Agriculture at the University of São Paulo (ESALQ-USP). The solution improves water availability in crops and increases the efficiency of phosphorus and nitrogen use. “The field results during veranicos [unseasonably warm and dry periods that can occur in autumn and winter] of up to 20 days were promising,” says agricultural engineer Marcos Petean, the company’s CEO.

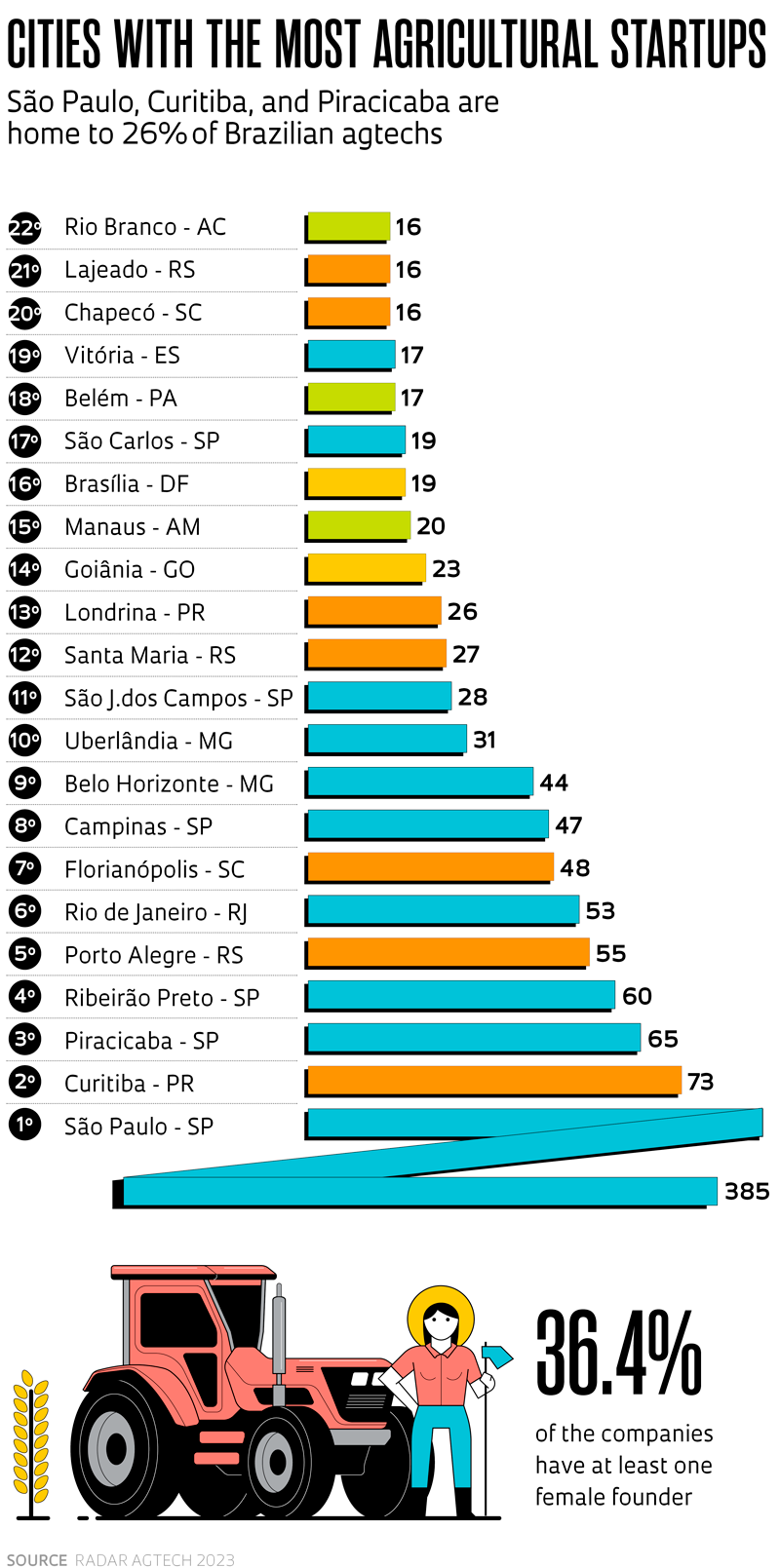

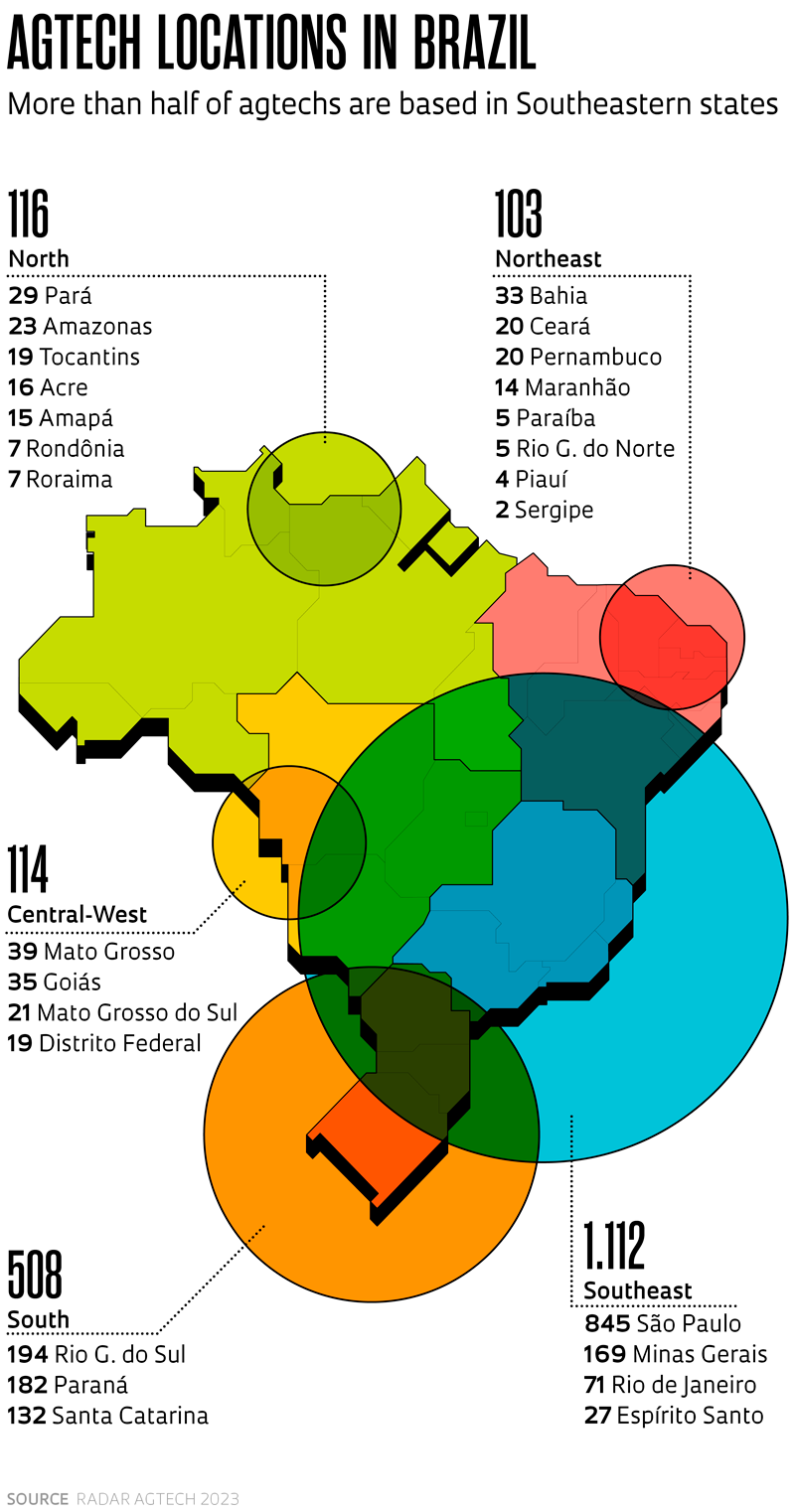

Over half of Brazilian agtechs (56.9%) are based in the Southeast region, including Gânica, but it was in the North that their numbers grew the most, rising from 28 to 116 identified companies. In 2023, this region’s share of all agtechs jumped from 1.5% to 5.9%, surpassing the Central-West (5.8%) and the Northeast (5.2%) (see infographic).

“A partnership with the Brazilian Support Service for Micro and Small Businesses [SEBRAE] allowed EMBRAPA’s team to identify more active startups that may not have been recorded in previous years,” explains Dias. He points out that the rise in the number of agtechs in the North could also be a result of programs such as SEBRAE‘s Inova Amazônia, which offers mentoring and scholarships to help entrepreneurs found startups—recipients can be awarded up to R$39,000 for a six-month period.

Bioplazon, based in Manaus, Amazonas, was one of the companies funded by Inova Amazônia in 2022 and identified in the Agtech Radar 2023 report. Created by former students from the Federal University of Amazonas (UFAM), the startup developed a rigid foam made from cassava and açaí processing waste, which is used to make bioplastic cups. “We developed a process that separates the starch, fiber, and cellulose from the cassava and fibers from açaí seeds [see Pesquisa FAPESP issue nº 323],” says company director Igor Araújo Pinto. “We use up to 80% of the waste, which is supplied by rural producers near Manaus.”

Based at the Amazon Biobusiness and Technologies Incubator (inBioTa), Bioplazon is preparing a market test with prototype 50-milliliter (mL) and 200-mL cups for coffee or ice cream, which will be offered to visitors at the marine aquarium in Rio de Janeiro. If the feedback is positive, Pinto intends to start selling the cups later this year.

Embrapa | Eduardo Cesar / Revista Pesquisa FAPESPBioplazon cup made from the processing waste of açaí and cassavaEmbrapa | Eduardo Cesar / Revista Pesquisa FAPESP

Targets of new investment

The 2023 Agtech Radar Report identified three groups of companies as most likely to attract investment in the near future: agfintechs, which offer financial services and facilitate the creation of digital marketplaces that bring together producers and buyers; climatechs, which develop technologies capable of reducing greenhouse gas emissions; and agbiotechs, which focus on biological pest control products that increase productivity.

Krilltech, like Gânica, is an agbiotech. The company, founded in the Federal District by scientists from the University of Brasília (UnB) and EMBRAPA, produces fertilizers based on arbolina, a nanoparticle that stimulates photosynthesis. Composed primarily of carbon, nitrogen, and hydrogen, the nanoparticle acts on a plant’s primary metabolism, encouraging energy production.