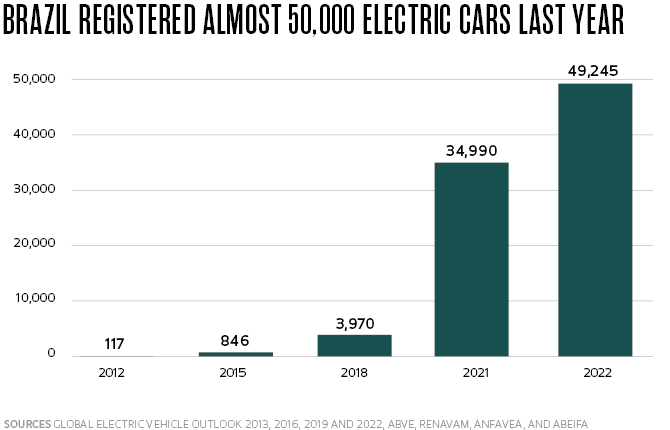

As part of the world accelerates towards electric car technology, Brazil is among a group of countries seeing only modest growth in the adoption of electric vehicles (EVs). This new type of vehicle has actually never been so popular in the country—a record 49,245 EVs were registered last year. But that figure is just a small portion of the nearly 2 million cars sold in Brazil. The market share rose from 1.8% in 2021 to 2.5% in 2022, with a total of 126,504 units now in circulation, according to the Brazilian Electric Vehicle Association (ABVE). Of these, those that are 100% electric—known as pure or battery electric vehicles (BEVs)—gained ground with an almost 200% increase in the number of registrations in 2022, or 8,458 new units. This demonstrates significant growth, but it is far from the pace set by countries like China, Germany, Norway, and the USA.

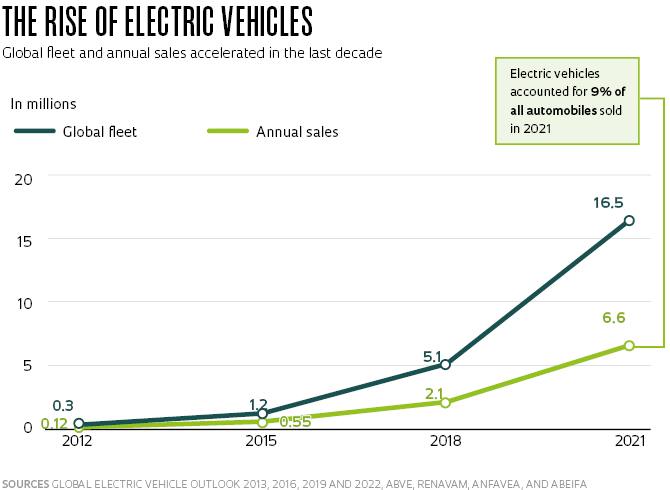

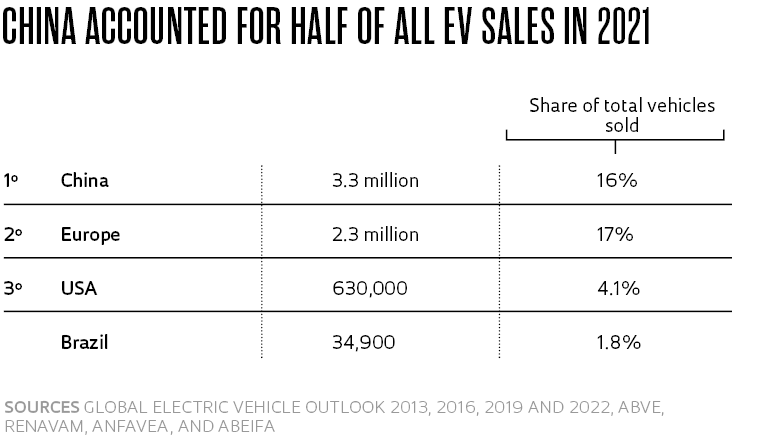

According to the 2022 edition of the “Global Electric Vehicle Outlook” report, published annually by the International Energy Agency (IEA), the global sale of EVs more than doubled between 2020 and 2021, reaching 6.6 million units. Half of the sales were in China, where 3.3 million EVs were sold in 2021, more than the 3 million sold worldwide in 2020.

Electric vehicles accounted for 16% of domestic sales in the Asian country in 2021. There was also strong growth in Europe, where they conquered 17% of the market. The continent is led by Norway and Iceland, where they represented 86% and 72% of registrations respectively in the year. The USA is well behind China and the leading European countries, with 4.5% of sales.

“We have a lot to celebrate, given the fact that the market has grown. But when it comes to 100% electric vehicles, those that depend exclusively on external charging, we are still at a very low level in relation to the rest of the world,” says Adalberto Maluf, who was ABVE president until the end of March, when he was named National Secretary of Urban Environments and Environmental Quality for the Brazilian Environment Ministry.

According to the expert, pure electric vehicles represented just 0.4% of total light vehicle sales on Brazil’s domestic market in 2022, while that figure was 20% in Germany and China and 18% in France and the UK. “We are a little behind the major world markets,” says Maluf.

In Brazil, hybrid electric vehicles (HEV) equipped with an internal combustion engine and one or more electric motors are currently more popular. These cars are refueled at gas stations and do not need to be plugged in to charge. Their batteries are powered by the combustion engine or braking energy, which is generally wasted in traditional cars. In 2022, flex-fuel HEVs had a 48% share of the Brazilian electric car market.

Eduardo Anizelli / Folhapress

Congestion in São Paulo: the transition to electric vehicles does not solve this problemEduardo Anizelli / FolhapressExperts are concerned about low EV sales in the country and see a level of inertia in the Brazilian market compared to the technological transition occurring in the more industrialized world. In an article published in Revista Brasileira de Inovação, sociologist Rodrigo Foresta Wolffenbüttel, a member of the Sociology Graduate Program’s Innovation Studies Group at the Federal University of Rio Grande do Sul (UFRGS), points to the lack of a robust policy supporting electric vehicle technology and the absence of charging infrastructure.

He also perceives a certain ambiguity among established automakers in the country, which do not always appear interested in transitioning quickly to electric cars. “They are in an ambiguous position because while their headquarters in other countries are making the transition to EVs, here in Latin America, they do not see the political effort to promote such a change, so there is less incentive to do so,” says Wolffenbüttel.

Both Maluf and researcher Flávia Consoni, from the Graduate Program in Science and Technology Policy at the Geosciences Institute of the University of Campinas (IG-UNICAMP), say that Brazil recently came close to implementing a specific policy for EVs, but it was rejected at the last minute. “In 2018, during the Temer administration, I took part in discussions on a new policy for the sector under the scope of the Rota 2030 program, which replaced Inovar-Auto, and I led a study to design a national plan for electric mobility in Brazil,” says Consoni.

At the time, Chile and Costa Rica were the only countries in Latin America to have such a plan, according to the expert. “Together with the various stakeholders in the sector and the MDIC [Ministry of Industry, Foreign Trade, and Services], we created a program for Brazil. We worked between Christmas and New Year, because the government was set to change with Bolsonaro assuming the presidency. But for some undisclosed reason, the MDIC decided not to launch the plan,” recalls the researcher.

Consoni, who also heads UNICAMP’s Electric Vehicle Study Laboratory (LEVE) and works at the FAPESP-funded São Paulo Center for Energy Transition Studies, points out that other countries in the region, such as Colombia, Panama, and Ecuador, now have plans with clear aims at growing the EV market. “Furthermore, both Argentina and Mexico, which have a strong automotive industry like Brazil, have already taken significant steps on this issue and are in the process of launching EV programs. In Brazil, we still do not know what the future holds.”

One of the decisions the country needs to take is whether to decarbonize the transport sector through complete electrification, opting for purely electric vehicles like the vast majority of countries that are adopting the technology, or whether to go with partial electrification via hybrid models that do not need to connect to the electrical grid.

According to the authors of the 2nd Brazilian report on electric mobility, published by the National Electric Mobility Platform, taking the fully electric route would require a total transformation of the business chain that would reach beyond the automotive sector. Investment would be needed in battery manufacturing, exploration of mineral resources, and retraining professionals, and the entire process would pose a major threat to the traditional industry. A partial change through hybridization, on the other hand, would take advantage of the current production and business structure. The article emphasizes that this approach would also be supported by the country’s experience with biofuels, especially ethanol.

Failing to make a decision on how the nation should expand its EV sector has more negative consequences than any other choice, experts warn. One potential implication is the loss of export markets for EVs, as most countries strive to lower or eliminate greenhouse gas (GHG) emissions in the transport sector.

Maluf says that Brazil has already been seeing a decline in vehicle exports in Latin America. “For at least five years, more than a third of the buses sold worldwide have been electric. Brazil was once the largest bus manufacturer and is now in third or fourth position. In 2022 we lost all tenders in Latin America because so few Brazilian automakers produce electric buses,” he says. “It’s worrying to become so disconnected from major changes happening in the rest of the world.”

For UNICAMP’s Consoni, there is a global technological bottleneck related to the batteries. “They are still very expensive and there are mining-related problems that need to be better worked on,” he says. A key component of the batteries is lithium, also called white gold. Like any mining process, lithium mining can have environmental and social impacts. Chile, Argentina, and Bolivia are among the world’s largest producers and have already experienced conflicts related to water shortages, soil contamination, and disputes between native peoples and private companies. The price of the metal at the beginning of 2023 was eight times higher than it was in 2021, according to the Financial Times. Although it only makes up a small part of the battery (about 4%), it is essential to its operation. Without it, the chemical reactions do not take place in the way they should. The advantage is that lithium batteries can store a large amount of energy in a relatively small volume.

Léo Ramos Chaves / Pesquisa Fapesp

Recharging batteries is one concern among motorists, according to a surveyLéo Ramos Chaves / Pesquisa FapespWhen it comes to technological development and battery production, China is the world leader. The USA, however, has made huge investments to catch up, especially under the current Joe Biden administration. “A whole infrastructure has been developed in other countries. Brazil only just seems to be starting to wake up,” says Maria de Fátima Rosolem, a chemist from the CPQD innovation center in Campinas who studies advanced batteries for EVs and stationary energy storage systems. “Every emerging technology needs a stimulus program—a government backing it. China has done this for a long time now. It encouraged companies to set up factories and it invested in research. Now it dominates the area” (see box).

According to Rosolem, research into new generations of batteries is attempting to advance on four fronts: range, lifespan, cost, and safety. “The issue of charging has been resolved. It is currently possible to recharge a car battery in 30, 15, or even 10 minutes.” One line of research is aiming to develop batteries with solid electrolytes instead of the currently used liquid electrolytes, which would make the battery safer. Studies and applications related to reusing the devices (known as second life batteries) are also progressing. When EV batteries reach the end of their lifespan, they can be revamped for energy storage, for example, and used in conjunction with distributed solar energy generation systems, explains the chemist.

In São Paulo, research groups funded by FAPESP are investigating new architectures and materials to increase the performance, storage capacity, and stability of lithium batteries. One such initiative is being carried out in partnership between the University of São Paulo (USP) and the University of Antioquia in Colombia. Other FAPESP-funded projects are studying alternative pathways and technologies for recycling this type of battery. One, for example, is investigating how to recover critical raw materials from batteries using environmentally sustainable technologies.

While the Brazilian government has not yet set a course for expanding the sector in the country, surveys suggest the public has a positive view of EVs. In an article published in the journal Transportation Research Part A, researchers from São Paulo State University (UNESP) in Bauru, the Federal University of São Carlos (UFSCar) in Sorocaba, and USP in Ribeirão Preto shared the results of a 2019 survey on public intention to use electric cars in Brazil: 89.1% of people said they would buy a battery-powered vehicle.

However, most of the 488 respondents said they were willing to pay a maximum of between R$30,000 and R$70,000, well below the price of an EV sold in the country at the time. “In 2019, the cheapest model cost more than R$100,000. It is clear that people did not have much idea of how much an electric car would cost,” says, Hermes Moretti Ribeiro da Silva, a professor of production engineering at UNESP and one of the authors of the article.

The survey identified price and the issue of recharging the battery as limiting factors to the sale of EVs. “Respondents were worried about charging stations and how they would recharge the battery. Above all, they were concerned about the issue of range,” emphasizes Silva. Experts agree that in a country the size of Brazil, the electric vehicle sector will rely on the existence of a large and easily accessible network of charging stations that meet consumer demand.

In a 2022 study by Rodrigo Wolffenbüttel for a book by the Brazilian Center for Analysis and Planning (CEBRAP) on the challenges faced by urban mobility in the twenty-first century, EV owners highlighted that despite the environmental benefits, the transition from internal combustion engines to electric cars will not solve a crucial problem in large urban areas: traffic jams.

“Most of the respondents raised this issue. This is still a bet on an individual answer to a collective problem,” says the sociologist. “In the end, switching to electric cars does not solve our urban mobility problems. It reduces local greenhouse gas emissions, but when it comes to the daily commute, you are stuck inside an electric car just as you are in a combustion vehicle.”

The Asian country began investing in electric vehicles at the turn of the century and now it leads the sector; Europe and the USA trail behind, with various obstacles to overcome

China is the runaway leader in the technological development, production, and consumption of 100% electric cars. The country’s commitment to research in the sector is not new. “Many years ago I supervised a master’s student who studied the Chinese automobile industry and the country’s efforts to be at the forefront of internal combustion engine technology, which was previously strongly dominated by European, Japanese, and North American companies,” recalls Flávia Consoni, from the Graduate Program in Scientific and Technological Policy at the Geosciences Institute of the University of Campinas (IG-UNICAMP). “Even before the new millennium, they pivoted to electric vehicles. They began investing much more heavily in the area and made it one of the priority focuses of their five-year plans.”

The USA and Europe have also focused their efforts on overcoming obstacles and strengthening the electric vehicle market. In addition to the technological challenges, especially those related to the battery cells, these countries also need to deal with a fossil-fuel-based energy mix that is not as clean as Brazil’s—which uses more hydroelectricity—and the need to install a wide-reaching charging network across large territories.

Other less obvious difficulties have been pointed out by experts, such as the inequality that electric vehicles can create between society’s richest and poorest, the latter of which often live in rural areas or regions without easy access to charging stations. Scientists from the University of Michigan, USA, published a study in January that shows that for those with the lowest income, recharging an electric vehicle would represent a significant annual expense.

“Early EV adoption patterns align with typical trends for most new technologies and while adoption tends to become more equitable over time, policy interventions are necessary to increase EV accessibility for vulnerable and excluded households,” emphasize the authors of the article.

Projects

1. CPTEn ‒ São Paulo Energy Transition Center (nº 21/11380-5); Grant Mechanism Science for Development Centers; Principal Investigator Luiz Carlos Pereira da Silva (UNICAMP); Investment R$3,754,810.12.

2. Architecture of materials for electrochemical energy storage and catalysis (nº 21/00675-4); Grant Mechanism Thematic Project; Principal Investigator Roberto Manuel Torresi (USP); Investment R$4,665,975.25.

3. Sustainable mining: Recovery of critical raw materials from batteries using environmentally sustainable technologies (nº 20/00493-0); Grant Mechanism Research Grant; Principal Investigator José Alberto Soares Tenório (USP); Investment R$144,401.69.

4. Technology for recycling lithium-ion batteries: Lifecycle engineering applications for the circular economy (nº 20/11874-5); Grant Mechanism Research Partnership for Technological Innovation (PITE); Principal Investigator José Augusto de Oliveira (UNESP); Investment R$199,188.49.

5. Mixed metal oxides for high-voltage lithium-ion batteries: The search for stability and safety (nº 20/03543-9); Grant Mechanism Research Grant; Agreement University of Antioquia (Colombia); Principal Investigator Roberto Manuel Torresi (USP); Investment R$177,275.37.

6. Beyond lithium-ion: Development of reversible non-aqueous metal-air batteries (nº 19/26309-4); Grant Mechanism Research Grant — Young Investigator Award; Principal Investigator José Augusto de Oliveira (UNESP); Investment R$1,017,961.70.

Scientific articles

WOLFFENBUTTEL, R. F. Políticas setoriais e inovação: Entraves e incentivos ao automóvel elétrico no Brasil. Revista Brasileira de Inovação. Vol. 21. 2022.

OLIVEIRA, M. B. et al. Factors influencing the intention to use electric cars in Brazil. Transportation Research Part A. Vol. 155, pp. 418–33. 2022.

VEGA-PERKINS, J. et al. Mapping electric vehicle impacts: Greenhouse gas emissions, fuel cost, and energy justice in the United States. Environmental Research Letters. Jan. 11, 2023.

rithm. Nature Biotechnology. Vol. 29, no. 5, pp. 411–6. 2011.