Established a century ago this year to audit public spending, the São Paulo State Audit Court has been shaped over the years by Brazil’s shifting political and institutional landscape. Created during the First Republic (1889–1930), the agency was dissolved during the Vargas Era (1930–1945) and later reinstated and reformed under the military dictatorship (1964–1985) and following the 1988 Constitution. Over the years, its scope of responsibilities has grown to include evaluating government management efficiency and fostering public participation in budget oversight.

To chronicle the institution’s centennial history, researchers led by legal scholar José Reinaldo de Lima Lopes and historian Íris Kantor, both from the University of São Paulo (USP), together with legal scholar Ariel Engel Pesso from Mackenzie Presbyterian University, researched the archives housed at the Audit Court and the São Paulo State Public Archives. Their research, conducted by a team of 21 researchers—including Audit Court interns and USP graduate students—culminated in the book A história do Tribunal de Contas do Estado de São Paulo: Primeiro centenário – 1924-2024 (A history of the São Paulo State Audit Court: First centennial record – 1924–2024; Edusp, 2024).

“Our first task was to organize the Audit Court archives,” says Kantor. The team cataloged more than 2,000 unidentified photographs and a large collection of records containing information on cases, judicial rulings, and legislative frameworks. In addition to collecting primary data, the researchers also interviewed six Audit Court counselors to gather insights into the institution’s recent history.

Brazil is home to 31 audit courts, including the Federal Audit Court (TCU), state courts (operating in all 26 state capitals and the Federal District), municipal-level courts within states (in Bahia, Goiás, and Pará), and city-specific courts in São Paulo and Rio de Janeiro. State-level municipal courts are subordinate to their respective state courts, while city-specific courts operate independently and autonomously.

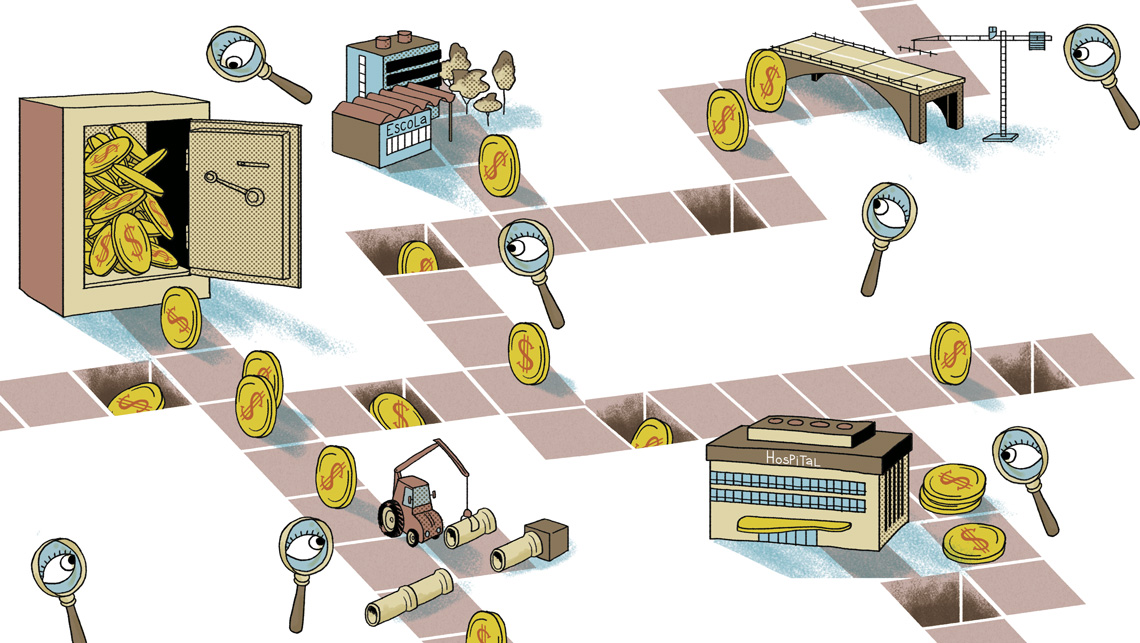

According to Guilherme Jardim Jurksaitis, a legal scholar at the Getulio Vargas Foundation in São Paulo (FGV-SP), the primary role of these institutions is to scrutinize public spending and accounts. This includes auditing government contracts, personnel expenditures, and partnerships with third-sector organizations. “Audit courts exercise overall oversight over how taxpayer money is spent,” explains Jurksaitis, who also serves as a technical advisor and prosecutor at the São Paulo State Audit Court.

While today’s audit courts have a wide scope of oversight, their original role was narrowly focused on accounting audits. This was the case for the São Paulo State Audit Court, established in 1924 by Washington Luís (1869–1957) during his tenure as governor of São Paulo (1920–1924). The agency was modeled after similar institutions in Europe and the Federal Audit Court (TCU), created in 1891. But just six years after it was established, the court was dissolved by a state decree in 1930, later to be reinstated in 1947.

Data provided by audit courts support the work of researchers and civil society organizations

During the economic boom of the 1950s and 1960s, the Audit Court expanded its oversight to address São Paulo’s growing public works projects. Notable activities during this period included approving land expropriations for the expansion of the University of São Paulo (USP) campus and overseeing faculty hiring and campus renovations. The study also uncovers a longstanding connection between the Audit Court and USP’s Law School. As noted by Pesso, approximately 65% of the officials who served on the court over the past century graduated from this institution. With the founding of FAPESP in 1960, the Audit Court assumed responsibility for auditing its accounts.

In 1968, during the military dictatorship, the São Paulo Municipal Audit Court (TCM-SP) was established to audit city finances. At the time, the State Audit Court strengthened its technical capabilities by appointing counselors and staff specialized in public finance. According to Pesso, as a government entity, the court initially aligned itself closely with the regime. However, this began to shift in the 1970s as opposition to the dictatorship gained momentum, leading the court to adopt a more critical stance toward the government.

The 1988 Constitution introduced significant changes, broadening the scope of audit court oversight beyond mere financial audits. “This marked a transition from a reactive to a proactive approach including preventive, concurrent, and retrospective oversight of public spending,” explains Pesso of Mackenzie University.

Ursula Dias Peres, a researcher at the Center for Metropolitan Studies (CEM) at USP—a FAPESP-supported Research, Innovation, and Dissemination Center (RIDC)—highlights that prior to the Real Plan in 1993, monetary instability and the use of physical accounting documents rendered budget oversight inefficient. This began to change in 2000, says Peres, with the passing of the Fiscal Responsibility Act (LRF). “This legislation established strict limits on personnel expenditures, public debt, and the granting of tax incentives,” adds Lopes from USP. The LRF also introduced requirements for public entities to disclose detailed information about their budgetary and financial activities.

Law No. 12,527 of 2011—the Access to Information Act (LAI)—was another landmark piece of legislation affecting Brazil’s audit courts, requiring public agencies to proactively disclose data and respond to information requests from the public. In response, the Audit Court implemented a Citizen Information Service to address such requests and launched a transparency portal featuring publicly accessible data on its activities.

Fernanda Filgueiras Sauerbronn, an economist and head of the Graduate Program in Accounting Sciences at the Federal University of Rio de Janeiro (UFRJ), has researched public budgeting and governance since 2010. She notes that while the Access to Information Act ensures access to budgetary information, true transparency requires active public engagement. “Laws alone will not guarantee accountability in the use of public funds,” she explains. Sauerbronn suggests that courts could offer training programs to help citizens use the Access to Information Act effectively, draft information requests, and follow up on agency responses. She also believes Brazil’s “tansparency portals” need to be more user-friendly by using plain language, graphs, and tables to make data more accessible and understandable.

Daniel Almeida

Daniel Almeida

Technological innovations in the 2000s transformed public financial oversight, according to Ursula Dias Peres. Automation replaced many manual tasks, and artificial intelligence (AI) has since become central to efforts to modernize audits. AI systems can cross-check financial and contractual data based on keywords and numerical patterns, significantly speeding up the analysis of revenues, contracts, and procurement. “AI flags anomalous data and helps identify irregularities, supporting more targeted audits,” says Peres.

But despite recent technological advances, audit courts are still faced with the challenge of preventing political interference in their activities. “Governors and lawmakers have significant sway in appointing court counselors, which can influence decisions about the approval or rejection of public accounts,” says Peres. Sauerbronn echoes this concern, recalling that in 2021, five counselors from the Rio de Janeiro State Audit Court were suspended over corruption allegations. “At that time, the only two counselors uninvolved in the scandal were career civil servants,” she notes. “To ensure audit courts operate independently, one solution is to ensure that counselor positions are filled by professionals selected through public service exams,” she concludes. Audit courts in several states have begun taking steps in this direction, says Sauerbronn. States like Ceará, Mato Grosso, and Espírito Santo launched their first public service exams for filling counselor positions approximately 10 years ago.

Another challenge, Sauerbronn notes, is scrutinizing so-called “parliamentary amendments.” These amendments allow lawmakers—both deputies and senators—to influence the allocation of public funds, often as part of commitments made to state or municipal governments or other organizations during their campaigns. “Over the past decade, allocations made through parliamentary amendments have significantly altered the dynamics of public budget control,” says Sauerbronn. This is because, explains Peres, there is no clear framework for auditing the funds allocated through these amendments. Audit courts are responsible for assessing both the financial management and effectiveness of government programs, agencies, and funds. Audit teams typically select a specific topic or initiative to evaluate and then design work plans outlining objectives, key audit matters, evaluation criteria, and methods for data collection and analysis. This involves reviewing a variety of documents, including laws, government plans, previous audit reports, and academic research.

However, the absence of specific regulations on how parliamentary amendments can be used creates opportunities for misuse. “It’s crucial to establish clear and objective criteria for regulating the allocation of these funds,” stresses Peres of CEM-USP. This ongoing issue led the Supreme Federal Court (STF) in August 2024 to order a temporary suspension of parliamentary amendments. The suspension will remain in place until the National Congress introduces measures to ensure effective oversight of the funds distributed through these amendments.

“Despite ongoing challenges and political interference in the oversight of public accounts, audit courts have become increasingly active in combating corruption and identifying misappropriation by broadening access to information and enforcing stricter auditing regulations,” says Peres. The data provided by audit courts also supports the efforts of civil society organizations like Transparência Brasil and Transparency International, and is widely used in academic research. Peres herself has incorporated audit court data into two recent studies.

In a 2022 study, she investigated how 11 state audit courts influence education spending. The study revealed that these courts can unintentionally exacerbate disparities in education funding by modifying federal guidelines. Disparities arise when states layer additional regulations onto federal rules, complicating compliance. Peres cites the Sergipe State Audit Court as an example. In regulating Maintenance and Development of Education (MDE) expenditures, the court followed the National Education Guidelines and Framework Law (LDB) but expanded the scope to include items not initially covered. Additional expenditures included payments to community and charitable organizations providing services to the government and the costs of organizing competitive exams for hiring teachers and staff.

In another study, completed in 2024 using data from reports by the São Paulo Municipal Audit Court (TCM-SP), Peres found that São Paulo City accrued a cash surplus of nearly R$25 billion between 2014 and 2023. This surplus resulted from increased revenues from Property Tax (IPTU) and Services Tax (ISS), as well as pension reforms for municipal civil servants. “The substantial cash reserve suggests that public funds are being underutilized, which limits the development and reach of municipal public programs,” Peres argues.

Jurksaitis also highlights the strategic role that audit courts play as repositories of administrative data. “The São Paulo State Audit Court, for instance, conducts annual on-site visits to over 3,000 entities under its purview, generating assessment reports and issuing alerts that can guide legislative interventions and preempt irregularities,” he notes.

The story above was published with the title “Following the money” in issue 346 of December/2024.

Projects

1. Center for Metropolitan Studies (CEM) (nº 13/07616-7); Grant Mechanism Research, Innovation, and Dissemination Centers (RIDCs); Principal Investigator Eduardo Cesar Leão Marques; Investment R$21.885.397,04.

2. Public budget governance: Comparative analysis of the cases of London and São Paulo (nº 19/09161-3); Grant Mechanism Research Fellowships Abroad; Principal Investigator Ursula Dias Peres; Investment R$109,459.28.

Scientific articles

PERES, U. D. Eleições municipais em São Paulo: Problemas e desafios. Estudos Avançados, 38 (111) , May–August 2024.

MACHADO, G. S. & PERES, U. D. A atuação dos Tribunais de Contas estaduais no controle da educação pública: Entre a mudança institucional e a produção de desigualdades regulatórias. Cadernos Gestão Pública e Cidadania, São Paulo, Vol. 28, 2023.

SAUERBRONN, F. F. et al. Decolonial studies in accounting? Emerging contributions from Latin America. Critical Perspectives on Accounting, Vol. 78, p. 1, 2024.

Book

LOPES, J. R. de L. KANTOR, I. PESSO, A. E. (Eds.). A história do Tribunal de Contas do Estado de São Paulo: Primeiro centenário – 1924–2024. Edusp, 2024.