Bárbara Malagoli In the 2015 ranking of patent applicants in Brazil, public universities came in first once again. There are 15 universities in the top 20 according to a survey by the National Institute of Industrial Property (INPI), the authority responsible for granting and ensuring intellectual property rights in Brazil. Four companies and one private research organization round out the list. Of course, multinational Whirlpool is in first place with 90 filings. However, it is followed by institutions of higher learning such as the Federal University of Minas Gerais (UFMG) with 56 applications, and the University of Campinas (Unicamp) with 52 (see infographic).

Bárbara Malagoli In the 2015 ranking of patent applicants in Brazil, public universities came in first once again. There are 15 universities in the top 20 according to a survey by the National Institute of Industrial Property (INPI), the authority responsible for granting and ensuring intellectual property rights in Brazil. Four companies and one private research organization round out the list. Of course, multinational Whirlpool is in first place with 90 filings. However, it is followed by institutions of higher learning such as the Federal University of Minas Gerais (UFMG) with 56 applications, and the University of Campinas (Unicamp) with 52 (see infographic).

The data confirm that the Brazilian science and technology system does not fit the mold. In developed countries, unlike what is seen in Brazil, companies and not universities are the organizations that apply for the largest number of patents. In the ranking of institutions in Germany with the most patents awarded there in 2015, companies are in 18 of the top 20 positions, and more than half of those are in the automotive industry: General Motors ranks first, with 436 patents granted according to data from the German Patent and Trade Mark Office.

These data are useful for pointing out trends, but they cannot be compared to Brazilian data, where statistics monitor applications and not registrations because of delays that exceed 10 years in reviewing patent applications. In the German ranking, the two public institutions among the top 20 are the Fraunhofer-Gesellschaft and the German Aerospace Center (DLR). In the United States, the domination by companies is more striking. The University of California, the first public institution to appear in the 2015 ranking of the United States Patent and Trademark Office (USPTO), is in 82nd place. Technology companies such as IBM, Samsung, Canon, Qualcomm and Google dominate the list.

Patents protect inventions and entitle holders to establish the conditions under which third parties are permitted to use the idea for a certain period of time. Companies take advantage of this instrument to protect their research and development efforts. “Patents are industrial property. Companies are usually the entities that are most interested in defending intellectual property,” says chemist Vanderlan Bolzani, director of the Unesp Innovation Agency, São Paulo State University (Unesp) office. It appears in 8th place in the INPI ranking, with 33 patents filed in 2015. “The Brazilian science and technology system is recent and is still being strengthened. Its private sector is historically risk-adverse. As a result, this concern has been on Brazil’s radar screen for only a short time.”

Brazil, the United States and Germany differ in terms of producing innovations and protecting intellectual property. For example, take an indicator that the Organization for Economic Cooperation and Development (OECD) uses to assess the international impact of patents and compare each country’s technology capability: triadic patent families (TPFs). Simply stated, these are patents granted in more than one country in order to obtain broad protection for an invention. Brazilian companies and institutions apply for 50 to 60 triadic patent families per year, while there were 14,200 such applications in the United States and 5,500 in Germany in 2013. “This disparity seems to show that in general, and with the standard noteworthy exceptions, most companies in Brazil carry out research and development for relatively modest goals related to the domestic market, with little chance of global impact, unlike companies in the United States, China, Spain or Germany. The characteristics of the Brazilian economy seem to interfere with the international drive of our companies,” says Carlos Henrique de Brito Cruz, scientific director of FAPESP.

Brazil, the United States and Germany differ in terms of producing innovations and protecting intellectual property. For example, take an indicator that the Organization for Economic Cooperation and Development (OECD) uses to assess the international impact of patents and compare each country’s technology capability: triadic patent families (TPFs). Simply stated, these are patents granted in more than one country in order to obtain broad protection for an invention. Brazilian companies and institutions apply for 50 to 60 triadic patent families per year, while there were 14,200 such applications in the United States and 5,500 in Germany in 2013. “This disparity seems to show that in general, and with the standard noteworthy exceptions, most companies in Brazil carry out research and development for relatively modest goals related to the domestic market, with little chance of global impact, unlike companies in the United States, China, Spain or Germany. The characteristics of the Brazilian economy seem to interfere with the international drive of our companies,” says Carlos Henrique de Brito Cruz, scientific director of FAPESP.

Although the fact that universities are predominant in patent rankings is the exception rather than the rule, the idea of a rapprochement between universities and the productive sector and an ongoing effort by research institutions to transfer knowledge to society is universally accepted. Brazil, the United States and Germany have laws whose purpose is to turn scientific results into applications in the private sector. In 1980 the United States enacted a law that has become a standard for other countries, the Bayh-Dole Act, which paves the way for companies, universities and research institutions to patent and market publicly funded inventions. In 2002 Germany implemented a reform that gave universities precedence by taking away researchers’ freedom to decide to patent innovations from their work, and universities took over first place. In Brazil, the benchmark is the 2004 Innovation Act. Among other measures, it provided that all science and technology institutions in Brazil would establish Technology Innovation Centers (NITs) to manage their innovation policies.

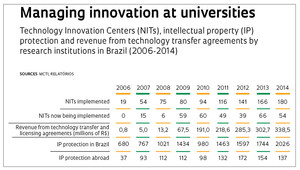

Data from the reports of the Form for Information on the Intellectual Property Policy of Scientific and Technology Institutions in Brazil (FORMICT), compiled by Carlos Américo Pacheco, professor at the Institute of Economics at Unicamp, show that the number of NITs operating in Brazil soared from 19 in 2006 to 180 in 2014, and that the different types of protection, such as patents, software and trademark registrations, climbed from 680 to 2,026 in Brazil during the period, and from 37 to 137 abroad. “This increase in the number of patents and the higher revenue reported in technology agreements is most impressive. This figure skyrocketed from less than one million reais in 2006 to roughly 338 million in 2014. The response from universities to the requests made of them in the Innovation Act was very positive. The stimulus for entrepreneurship that this change in culture brings with it is another positive aspect. The question is whether this movement makes sense financially because patents come with a cost,” says Pacheco, former chief executive officer of the FAPESP Executive Board.

In 2000, 85% of all patent filings in Brazil were concentrated at 20 universities. In 2012, that figure dropped to 60%, a sign that more institutions are involved in this activity. Júlio César Castelo Branco Reis Moreira, patent director at the INPI, believes that NITs are bolstering interest in innovation among companies and universities. “The centers help set up partnerships with companies that are still in the early stages of research.”

Disruptive innovation

A forerunner of NITs, the Agency for Innovation (Inova Unicamp) became the leader among Brazilian universities. Founded officially in 2003, it already existed in the 1980s as the Standing Committee on Intellectual Property and Office of Technology Transfer (see Pesquisa FAPESP Issue nº 155). The inventory of protected technologies surpassed 1,000 active patents, 131 of which were licensed to companies. In 2015, revenue from royalties reached R$2 million. “Our dream is to license disruptive innovation that generates significant resources,” says Milton Mori, executive director of Inova Unicamp.

The NIT experience shows that university investment in patents and licensing technologies is justified not by the potential direct financial return, but by the establishment of a wealth-generating environment of innovation throughout the institution. In this regard, Unicamp’s results have been significant: 434 companies in the university incubator or companies founded by individuals with links to the institution. In 2015, these Unicamp offshoots had over 20,000 employees, and their sales amounted to more than R$3 billion.

Academic patents are rather expensive. The 2015 data from the Association of University Technology Managers (AUTM) show that universities in the United States invested $66.5 billion in research and applied for 15,953 patents, for an average amount of $4.2 million spent on research for each patent. In most cases, technology licenses and patent sales do not cover the costs that innovation agencies incur. “Even at US universities, it takes 100 university-company partnerships to develop 10 patents, and of that number, one will be licensed,” says INPI’s Moreira.

Academic patents are rather expensive. The 2015 data from the Association of University Technology Managers (AUTM) show that universities in the United States invested $66.5 billion in research and applied for 15,953 patents, for an average amount of $4.2 million spent on research for each patent. In most cases, technology licenses and patent sales do not cover the costs that innovation agencies incur. “Even at US universities, it takes 100 university-company partnerships to develop 10 patents, and of that number, one will be licensed,” says INPI’s Moreira.

This problem has not even spared Stanford University, which in 1970 was the first institution to establish an Office of Technology Licensing. In a recent report, the office stated that as of 2017, for the first time in more than three decades, the 15% fee levied on royalties from licenses will not be sufficient to pay for its operations because patents with a high economic value have expired, even though Stanford obtains 180 patents per year in the United States, and 20 to 25% of those technologies are licensed.

Recently, the Unesp Innovation Agency decided to stop paying the fees INPI charges to maintain dozens of patent applications and registrations because it found that there was no interest in licensing them. To maintain a patent, applicants must pay an annual fee of R$295; the amount increases to R$590 if the fee is not paid on time. Once the patent is granted, the annual fee is between R$780 and R$2,000; the older the patent, the higher the fee. “We draw up a list to determine which patent applications and registrations should be abandoned, and we select the very old ones that were already offered unsuccessfully to many companies,” Bolzani says. The agency was established seven years ago and its team administers over 300 patents. The university continues to look for applications for its technologies. In a pilot project, some items in the Unesp patent application portfolio are being reviewed to be included in a program with the São Paulo State Paula Souza Technology Education Center and other funding entities, and technical and economic viability studies will be conducted. “We expect that this will help find companies and institutions to exploit Unesp innovations,” Bolzani says.

Patent drafting

Patent drafting

Another highlight is the work of the Innovation and Technology Transfer Office (CTIT) at the Federal University of Minas Gerais (UFMG). The CTIT, responsible for 818 patent filings in Brazil and 200 others abroad, has already entered into 87 licensing contracts. It began operating 20 years ago, focusing on patents, and as of 2006, it began working on other fronts to transfer technologies. “We are one of the few universities in Brazil in which patents are drafted by an in-house team,” says Juliana Crepalde, general coordinator of the CTIT. The patent drafting team has seven members, all of whom are experts in chemistry, pharmaceuticals and engineering. “Most agencies use specialized offices for this.”

Founded in 2005, the USP Innovation Agency has gone through some remarkable changes. Fifteen years ago, it filed between five and 10 patents per year, while today that figure is up to 60 to 80 applications annually. Technology licensing is still low, at about five per year. Physicist Vanderlei Bagnato, coordinator of the agency, says that the economic crisis has disrupted plans to reach R$5 million in revenue from royalties; today, that amount is roughly R$2 million. “Sales to companies to which we transfer technologies have declined, and royalty collection has run out of steam,” he explains. “Also, companies are less interested in licensing patents.” To deal with the situation, the strategy is to negotiate patents at token prices. “But we agree that three years from now we’ll start up the discussion again, depending on earnings. We are negotiating these terms with 20 firms,” he says. Another concern is to bring USP research groups and companies closer together in the hope that they will establish partnerships. “The number of new USP business projects is holding steady at about 70 to 90 per year,” Bagnato says. “The patents that these partnerships generate belong to the companies as well.”

The USP Innovation Agency initiative is not an isolated example. Two years ago, UFMG began to disseminate the work of its research groups in search of partnerships with companies. Already, 90 co-development agreements have been negotiated, and they include teams of researchers from UFMG and partner companies. The Inova Unicamp agency has been looking for companies—not to offer patents, but to disseminate the work of the Unicamp groups that are responsible for establishing partnerships. “Whenever a patent comes out of a collaborative effort between a university and a company, the chances that the company will use that technology improve significantly,” Mori says.

Republish