The COVID-19 pandemic has put a spotlight on one of the most dynamic sectors of the modern economy: life science. Following the outbreak of the Sars-CoV-2 virus, the ensuing race to develop vaccines and treatments for the disease, and produce vital medical equipment, set in motion the cogwheels of a medical-industrial complex in which science, technology, funding, and public policy are intermeshed. In Brazil, the pandemic has underscored the importance of an industry that accounts for 9.2% the country’s Gross Domestic Product (GDP) according to the Brazilian Institute of Geography and Statistics (IBGE). Together, the National Healthcare System (SUS), the pharmaceutical industry, vaccine producers, medical equipment manufacturers, private hospitals, and other organizations form what in Brazil has been termed the Health-Industry Complex (CEIS, in the Portuguese acronym).

Development of the country’s policy framework for the life sciences industry has been a gradual process, explains Elize Massard da Fonseca, a professor at the São Paulo Business School (EAESP-FGV) who is leading a FAPESP-funded research project titled “Policies to increase the competitiveness of the pharmaceutical sector: Brazil’s experience.” Throughout the twentieth century, says Fonseca, science and technology and healthcare were largely treated as separate, siloed policy concerns. But extensive advocacy by researchers and other actors, economic and social circumstances, regulatory developments, and government decisions have led to a gradual expansion of the role of science and innovation in healthcare policy, along with a growing focus on life sciences in research and technology policies.

Fonseca refers to this process as “policy layering”, in which institutional policies are incrementally amended and revised in response to either the entry of new actors or the need to correct errors. In a recent paper on institutional reform, she shows how institutions change not through abrupt measures, but in a gradual process when existing approaches are shown to be inadequate in the light of new circumstances.

Fonseca reviewed official documents, researched newspaper archives, and held around 30 interviews over the space of four years to reconstruct the long trajectory that led to the introduction of science and technology policy in the Brazilian healthcare industry. She found that the life science sector’s recognition as a strategic industry in industrial policy in 2013, and the expanding role of the Brazilian Development Bank (BNDES) in funding research in the industry, were not incidental developments but the result of a three-decade journey from early advocacy by researchers and other professionals to the policies existing today.

Radis archive / ENSP / Fiocruz

Hésio Cordeiro (

left) and Sérgio Arouca during the 8th National Health Conference in 1986: public-health physicians played an important role in creating the SUS

Radis archive / ENSP / FiocruzHealthcare reform movement

The first step in the process that culminated in the health science policies of the twenty-first century was the healthcare reform movement of the 1970s and 1980s. This period saw the creation of institutions such as the Brazilian Center for Health Studies (CEBES), in 1976, and the Brazilian Association of Collective Health (ABRASCO), in 1979. Some of the leading public-health physicians in the movement, such as Sérgio Arouca (1941–2003) and Hésio Cordeiro (1942–2020), played a prominent role in the creation of the SUS.

During that period, discussions and efforts were largely focused on healthcare services proper, says Reinaldo Guimarães, a public-health researcher at the Federal University of Rio de Janeiro’s Center for Bioethics and Healthcare Ethics (NUBEA/UFRJ) and deputy chairman at ABRASCO, who formerly served as Secretary of Science, Technology, and Strategic Inputs in the Brazilian Ministry of Health (SCTIE-MS) from 2007 to 2010. Some of the most widely advocated policy propositions in the period were the devolution of healthcare services to municipal governments, and the creation of a national healthcare system.

In 1986, the 8th National Health Conference, over which Arouca presided, laid the groundwork for what would later become the SUS—the system was incorporated in the Constitution of 1988 and formally created by an organic law in 1990 (Law no. 8080). Although not the primary aim of its creators, the SUS incidentally gave new momentum to the health economy and to science and technology programs. “The creation of the SUS is a landmark in the industry as it created huge demand in life science sectors,” says Fonseca. Even today, the system remains Brazil’s largest buyer of drugs, vaccines, and medical equipment.

The concept of an integrated Health-Industry Complex (CEIS) derives from Brazilian academia. Economist Carlos Grabois Gadelha, a researcher at the Oswaldo Cruz Foundation’s National School of Health Policy (ENSP-FIOCRUZ), who served as SCTIE-MS secretary from 2011 to 2015, recalls how the concept occurred to him while working on a project about vertically integrated supply chains. The term first appeared in his 2003 paper, “O complexo industrial da saúde e a necessidade de um enfoque dinâmico na economia da saúde” (The health-industry complex and the need for a dynamic approach to the health economy).

“The CEIS concept treats healthcare as an economic space that generates both wealth and wellness. Social programs are reliant on a vigorous economic system, as they are sensitive to swings in the economy. And a vibrant economic system needs to be underpinned by innovation,” says Gadelha. The pandemic, he continues, illustrates the importance of an integrated CEIS: “Innovation has become central to economic sustainability in healthcare.”

Three institutional landmarks in the 1990s indirectly set the stage for the incorporation of research and innovation policies into the healthcare sector. The first was the opening of Brazil’s economy by President Fernando Collor de Mello (1990–1992), who abolished tariffs on Brazilian imports of medical equipment and medicines. As a result, many manufacturers that relied on protectionist policies vanished from the market.

“Up until the 1980s there had been a major effort build a strong local pharmaceutical industry in Brazil, including the production of petroleum-based pharmaceutical ingredients. We had approached self-sufficiency,” says economist Lia Hasenclever of the UFRJ Institute of Economics and Universidade Cândido Mendes (UCAM). “The economic opening put an end to these ambitions, and multinational companies soon discontinued their operations here when they realized Brazil was uncompetitive without the tariff barriers.”

In 1994, Brazil joined the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS). As a requirement under the international treaty, Brazil introduced a patent law two years later that directly affected the local pharmaceutical industry, which had relied on the country’s non-recognition of patents on several drugs to produce so-called “similar” drugs.

The rapid approval of the new patent law, says Guimarães, carried important consequences for local industry: Brazil waived the 10-year grace period permitted by the treaty, and the intellectual property rights of foreign patent holders became immediately enforceable. In his book Intellectual property rights, the WTO, and developing countries, Carlos Correa, a jurist and economist at the University of Buenos Aires, argues that the rapid adoption of intellectual property laws was the result of pressure from the US pharmaceutical industry.

But one mechanism in the 2001 TRIPS agreement would be instrumental in the development of public health programs in the following decade: compulsory licensing, an allowance made when a local producer is unable to negotiate a voluntary license with the patent holder in consideration of reasonable royalties. Compulsory licensing is permitted directly in cases of national emergency or other circumstances of extreme urgency, or for public non-commercial use. In 1999, the Brazilian Ministry of Health threatened to break patents under the compulsory licensing provisions in an attempt to force deals with pharmaceutical companies for drugs used to treat AIDS. Only one patent would ultimately be broken, for the drug Efavirenz, in 2007.

In 1999, a “Generics Law” was introduced to provide incentives for local drug production in Brazil. “The Patent Law and the Generics Law were important milestones that would shape healthcare policy in the following decade,” says Fonseca. To overcome barriers that were met with in 1990s, researchers linked to the healthcare reform movement—who in the 1980s had spearheaded the development of a health policy framework for the New Republic established by the 1988 Constitution—became involved in crafting policies on research and development in healthcare, helping to create a legal framework for the sector, a dedicated department under the Brazilian Ministry of Health (MS), and direct government incentives for pharmaceutical companies.

Eduardo Knapp / Folhapress

A demonstration at Sé square in São Paulo supporting the federal government’s decision to break a patent on an AIDS drug in 2007

Eduardo Knapp / Folhapress Industrial policy

The final report of the 1st National Conference on Science, Technology, Innovation, and Health, in 1994, recommended the creation of a dedicated department under the MS to oversee investment in science and technology. This recommendation would only be fully implemented in 2007 with the creation of the Department of Science, Technology, and Strategic Inputs, which succeeded the Department of Science & Technology (DECIT) created in 2000. In 2008, under Minister José Gomes Temporão (2007–2011), the CIES was centralized under the now-defunct Executive Group for the Health-Industry Complex (GECIS).

Fonseca also underlines the role the BNDES has played in funding medical research, especially after the introduction of Brazil’s Industry, Technology, and Foreign Trade Policy (PITCE) in 2003, which included life sciences as one of four strategic industries. “The BNDES has been an important enabler of the life sciences industry, supporting companies in forming joint ventures and setting up technology transfer agreements,” she says. “We typically think of industrial policy as being the result of lobbying to benefit certain industries, but in the case of the life sciences industry, scientists, and researchers were clearly among the most influential through their efforts in previous decades: they developed conceptual frameworks, put pressure on the government, and were actively engaged in policymaking,” she concludes.

During this period, financial mechanisms created to strengthen the life sciences industry had a direct impact on research and development activity. The first, launched in 2004, was the Pharmaceutical Supply Chain Development Program (PROFARMA). But the most important mechanism, say researchers, is the Industry Development Partnership (PDP) system introduced in 2012 to formally implement the provisions of the National Framework for Public Production and Innovation in the Health-Industry Complex, adopted in 2008. In this system, the MS publishes a list of products that are strategic for the SUS, represent a significant cost for the government, and account for a large share of imports. Companies agree to transfer technology to government laboratories in exchange for firm orders for these products over a period of 10 years. After this period, the public laboratory acquires ownership of the technology.

This is the mechanism that local pharmaceutical companies have recently used to launch biosimilars, or medical products that are similar to other medicines produced by biological processes—generics differ in that that are produced through chemical synthesis. “The executives I interviewed would always remark about the sheer size of the SUS market and how being in the SUS vendor list meant many years of guaranteed orders,” says Fonseca, adding that often those same executives would deny needing help from the government. “But when we look at the list of BNDES partnerships concluded between 2008 and 2017, those very same companies are all there,” she notes.

Today, local pharmaceutical companies account for 80% of the generics market and have now developed the capabilities to invest in research and development (R&D): private Brazilian-owned or Brazilian-based companies invest an average of R$19 million per year in R&D according to the 2015 IBGE Innovation Survey (PINTEC), notes Hasenclever. That’s little for global standards, in an industry where R&D investment is worth US$160 billion per year.

André Médici, a former senior health economist at the World Bank, says these policies have failed to provide much of a boost to life science research due to the lack of “scientific capabilities at universities and research centers” and “incentives to translate research into business opportunities.” Médici notes how Brazil scores low in business opportunity rankings. The production of generic and biosimilar medicines involves little in the way of innovation, as “there is a large market in Brazil for products manufactured locally using technologies developed in other countries,” he says.

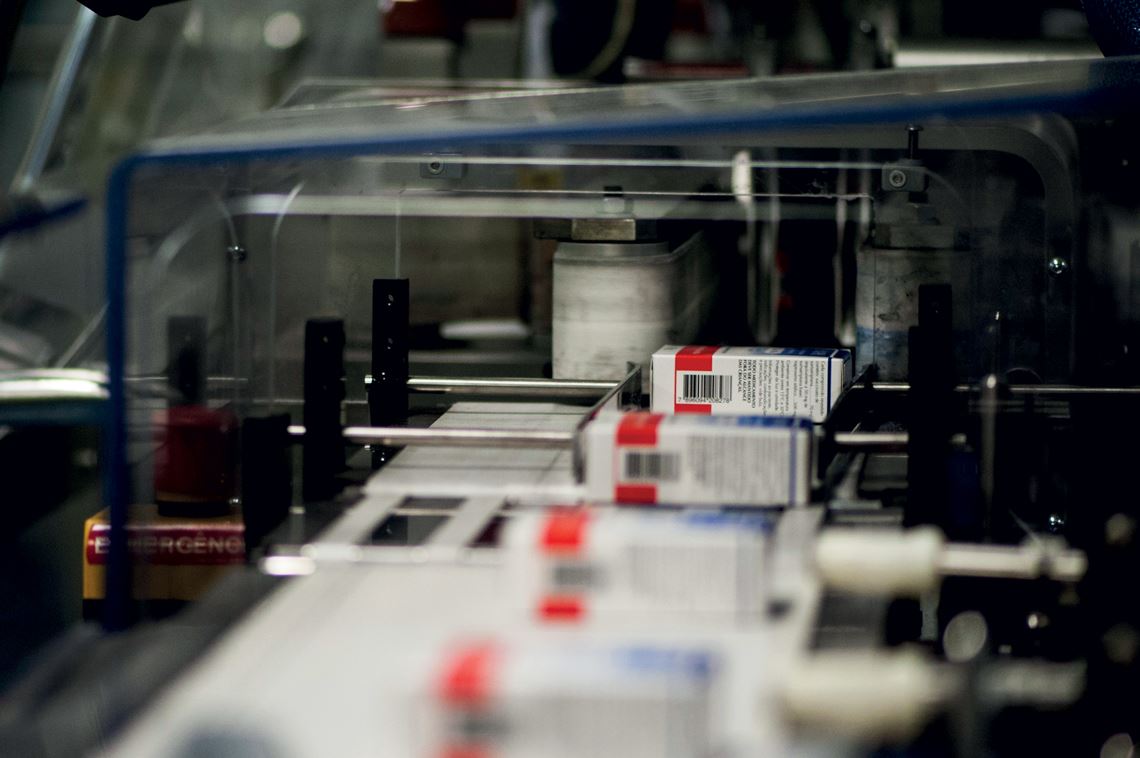

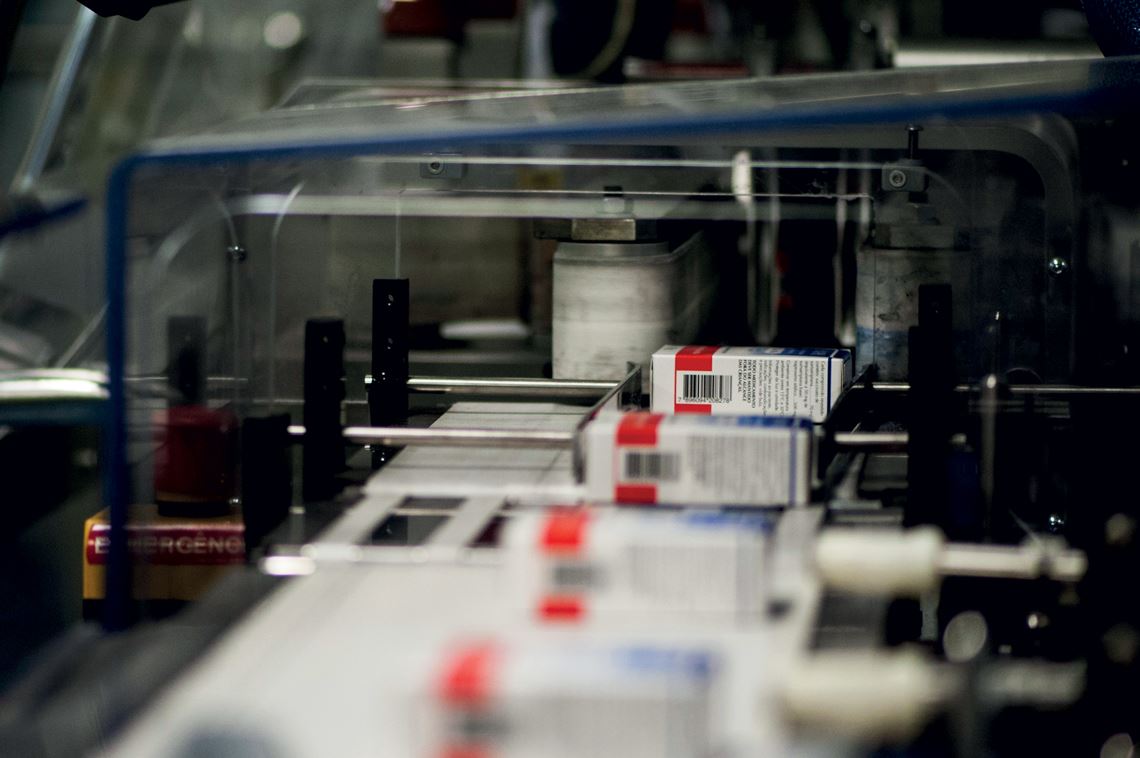

Léo Ramos Chaves

Drug production at a pharmaceutical company: Brazilian-owned and Brazilian-based pharmaceutical companies invest little in life science R&D compared to global standards

Léo Ramos Chaves “Incentives for the private sector or for research partnerships with international companies, reducing costs as an inducement for them to locate in Brazil, would be beneficial in accelerating research and development,” suggests Médici. He notes, for example, how less than 3% of clinical trials are conducted in Brazil, according to the Global Innovation Index 2019. “Brazil’s participation is lowest in the most innovation-intensive stages. More clinical trials done locally could give the country a stronger presence in global life science research networks,” he says.

For Hasenclever, industrial policy needs to be reformulated to extend beyond technology transfer and include measures to help companies build local research capabilities. “The National Healthcare Strategy currently being discussed in congress [Bill no. 2583/20] provides mechanisms for government purchases with technology transfer as an offset. But it’s not enough. We should also be expanding technology procurement,” he says, referring to a mechanism created by the Brazilian Innovation Act (Law no. 10973/04) in which the government can commission research and development projects even at the risk that they may fail.

Researchers’ greatest concern today is Brazil’s low levels of research investment, a situation now exacerbated by a freeze on the National Fund for Scientific and Technological Development (FNDCT) (see article on page 54), and especially the sectoral funds for healthcare and biotechnology. They are confident, however, that Brazil is in a position to enter niche markets in the life science economy over the coming decades, both in the pharmaceutical industry and in sectors such as medical equipment, provided the regulatory framework is improved and companies receive needed government support.

“There is a risk that Brazil could lose ground in life science research areas that are dependent on federal government support, not only because the country is in an economic and fiscal crisis but also because the current administration has deprioritized science and technology,” warns Médici. But despite the federal government’s shift in priorities, says Fonseca, the core elements of Brazil’s healthcare research programs are still in place. “Although investment has been curtailed, the public programs themselves are still there. The PDP contracts are still in place. The BNDES no longer has a dedicated lending facility for the pharmaceutical industry, but companies can still get funding elsewhere. And the SCTIE has not been disbanded,” she concludes.

Project

Policies for the competitiveness of the pharmaceutical sector: an analysis of the Brazilian experience (nº 15/18604-5); Grant Mechanism Young Investigator Award; Principal Investigator Elize Massard da Fonseca (EAESP-FGV); Investment R$848,810.00

Scientific articles

Fonseca, E.M. et al. (2019). “Integrating Science, Technology and Health Policies in Brazil: Incremental Change and Public Health Professionals as Agents of Reform”. Journal of Latin American Studies, vol. 51, no. 2, pp. 357–377.

Fonseca, E.M. (2018) “How can a policy foster local pharmaceutical production and still protect public health? Lessons from the health-industry complex in Brazil”. Global Public Health, vol. 13, no. 4, pp. 489–502.

Gadelha, C.A.G. (2003) “O complexo industrial da saúde e a necessidade de um enfoque dinâmico na economia da saúde”. Revista Ciência e Saúde Coletiva, vol. 8, no. 2, pp. 521–535.

Guimarães, R. et al. (2019). Política de Ciência, Tecnologia e Inovação em Saúde. Revista Ciência & Saúde Coletiva, vol. 24, no. 3, pp. 881–886.

Guimarães, R. (2004) “Bases para uma política nacional de ciência, tecnologia e inovação em saúde” Revista Ciência & Saúde Coletiva, vol. 9, no. 2, pp. 375–387.

Hasenclever, L. et al. (2016) “Alteração do Padrão de Esforços de Inovação das Grandes Empresas Farmacêuticas no Brasil”. In: Hasenclever, L. et al (org.). Desafios de operação e desenvolvimento do Complexo Industrial da Saúde. Rio de Janeiro: E-Papers.

Republish