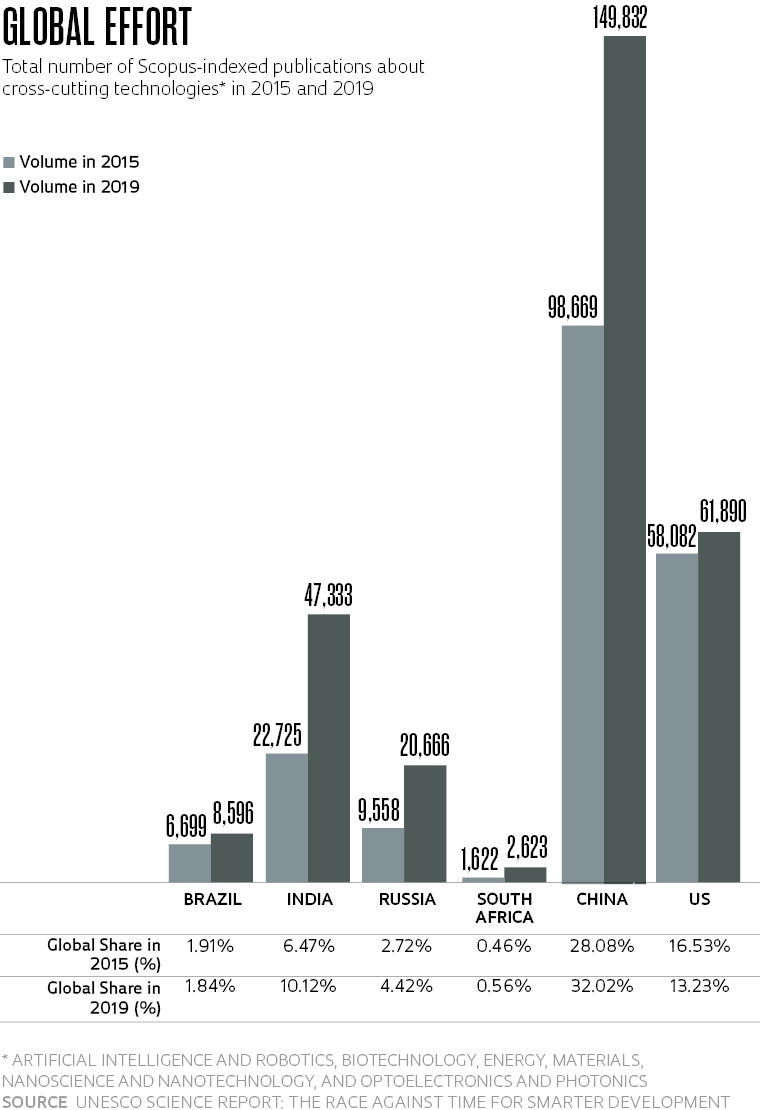

As global economies become increasingly competitive, many countries are accelerating their investments in a set of disruptive technologies with the potential to impact multiple industries, referred to as “cross-cutting technologies.” A recent report from the United Nations Organization for Education, Science, and Culture (UNESCO) looked at countries’ performance on six cross-cutting technologies considered strategic for their industrial future—artificial intelligence and robotics, biotechnology, energy, materials, nanoscience and nanotechnology, and optoelectronics and photonics—and found that Brazil is lagging its global peers on related research effort. The survey, titled the UNESCO science report: The race against time for smarter development, based on data from publisher Elsevier’s Scopus database, shows that scientific output in these fields has either stagnated or, in some cases, contracted in Brazil. The country went from 6,699 related papers in 2015 to 8,596 in 2019, an increase of 28.3% in absolute terms but the smallest gain among its BRICS peers—Russia, India, China, and South Africa. As a result, Brazil’s already meager share of international research in these fields has shrunk even further—from 1.9% of global publications about cross-cutting technologies in 2015, to 1.8% in 2019.

The six technologies selected for the report have strategic importance for the scientific and economic strength, technological superiority, and security of nations—not surprisingly, they accounted for 18% of global science output in 2019. Brazil’s worst performance was in optoelectronics and photonics, a field that is playing an important role in building data transmission capacity and the next generations of communications systems, such as 5G. Brazil’s scientific publications in this field contracted by 16%, from 405 in 2015 to 341 in 2019. Progress has been similarly slow in nanoscience and nanotechnology, with publications in this area increasing by only 37 from 2015, reaching 293 in 2019. “These fields are involved in the design of complex devices, and are reliant on a robust electronics industry that is non-existent in Brazil,” says Osvaldo Novais de Oliveira Junior, a physicist from the São Carlos Physics Institute (IFSC) at the University of São Paulo (IFSC-USP).

Brazil has performed somewhat better in biotechnology, with the country reporting a 51% increase in the number of papers in this area, from 684 articles in 2015 to 1,032 in 2019. This has slightly increased Brazil’s weight in the international research effort in this field—its 4.1% share of global biotechnology publications in 2015 rose to 5.5% in 2019. Carlos Alberto Moreira-Filho, a professor at the USP School of Medicine, says “Brazil’s strongish performance in biotechnology is primarily thanks to research in fields related to agriculture—like biological pest control and genetic crop improvement—and, to a lesser degree, applications in life sciences, such as studies on recombinant DNA and monoclonal antibodies.” Oliveira, of IFSC-USP, says the numbers reflect Brazil’s advancing capabilities in agricultural technology, with research institutions developing studies supported by steady, long-term investments and close collaboration with industry, which can’t be said of other fields.

The growing number of scientific publications about cross-cutting technologies provides a measure of countries’ efforts to keep their industries at the cutting edge of frontier technologies—such as Industry 4.0 or advanced manufacturing, and the shift toward more integrated, connected, and intelligent manufacturing processes—to make them more competitive and to boost exports. “Universities don’t actively create demand, but will respond to society’s needs for research and skilled labor,” says Renato Pedrosa, a professor in the Department of Science and Technology Policy at the University of Campinas (UNICAMP). He explains that countries with low levels of industrial activity demand less of this type of research. “Brazil’s poor research performance in these fields isn’t surprising, as research funding is inadequate and there is little domestic demand from world-class companies producing high-tech products.”

Contrasting with the situation in Brazil, in the US there appears to be a bipartisan consensus view that the country needs to revitalize its industry to counter the threat to its economic and technological leadership from China and other nations. This has led the federal government to prioritize key strategic platforms in digital technology, in fields that include artificial intelligence, quantum computing, and advanced mobile network technology. Among the flagship initiatives adopted by the US government is Manufacturing USA, a network of institutes created in 2014 to foster academic and industry collaboration in developing new technologies and manufacturing processes, and building a skilled workforce. Sixteen Manufacturing USA institutes have been established since 2012, each focused on a different process or technology. Collectively, these institutes reach 1,291 member organizations, of which 844 are manufacturing firms and 65% are small and medium-sized manufacturers. This strategy is estimated to have contributed US$ 2.3 trillion to the US economy and to have helped create more than 12 million jobs, while accounting for the bulk of private-sector research in technologies that are strategically important for the country’s industrial future.

More recently, the US Congress unveiled a bipartisan proposal, the Endless Frontier Act, that would create a dedicated technology and innovation department within the National Science Foundation (NSF), the leading funder of basic science in the country. The new department would have a budget of US$100 billion over five years for research in areas such as artificial intelligence and robotics, quantum computing, advanced communications, and data management (see Pesquisa FAPESP issue no. 304).

China has also understood the importance of cross-cutting technologies and has invested for decades in institutional mechanisms to drive development and adoption in industry. This strategy has led to the establishment of large business conglomerates—such as Huawei in information and communication technologies, and Yingli Green Energy and Mingyang in energy—that have now become globally leading players in strategic industries. Chinese efforts were further bolstered in 2015 by the launch of a new industrial policy to reduce these and other corporations’ dependence on foreign high-tech suppliers by 2025. The policy encourages Chinese companies to expand their global market share of electric vehicles, agricultural technologies, maritime and aerospace engineering, synthetic materials, emerging biomedicine, and high-end rail infrastructure.

China also aspires to become a global innovation hub for artificial intelligence by 2030, as does India, where scientific production in this field leaped by 189% from 2015 to 2019. “But the interest of governments in these technologies extends beyond applications in industry,” explains Roseli Francelin Romero, a professor of electrical engineering at the USP Institute of Mathematical and Computer Science (ICMC). “They can also be combined with networking and big data technologies to develop advanced cybersecurity solutions.” For Oliveira of IFSC-USP, “the concept of national security now extends beyond a nation’s military power to include its ability to develop cybersecurity technologies natively and reduce its dependence on foreign strategic resources.”

Brazil was late to realize the importance of these technologies. “Brazilian industry, which is heavily reliant on solutions developed in other countries, is currently only scratching the surface when it comes to deploying these technologies,” says Mariano Laplane, an economist at the UNICAMP Institute of Economics. This reflects historically low levels of investment in plant expansions and upgrades, due to a shrinking domestic market and the way Brazilian companies have struggled to compete in the global marketplace, he explains. A joint survey by UNICAMP, the Federal University of Rio de Janeiro (UFRJ), and Fluminense Federal University (UFF) between November 2019 and June 2020, paints a less-than-encouraging picture. Only 5% of the 982 companies in the survey were found to be operating at the technological frontier. “Nearly half of them are using obsolete digital solutions and have no plans to implement new ones within the next five years,” says João Carlos Ferraz, an economist at the UFRJ Institute of Economics who co-authored the study. “The best-performing companies are larger, invest more in R&D and training, and export more.”