Niobium, a ductile, shiny, and versatile metal, was little-known to most Brazilians until it recently attracted media attention and became a subject of debate during the presidential elections in Brazil. Social media posts warned that Brazil’s niobium reserves—the largest in the world—were being lost to contraband or being sold for less than their value on the international market. The then federal deputy and now president Jair Bolsonaro, an enthusiast of the metal for its multifunctionality, was among those engaged in the debate. In a 20-minute video, he lauded the virtues of niobium: its use as an alloying element in steels and in high-tech applications such as electric car batteries, optical lenses, particle accelerators, orthopedic implants, and jet engines.

He recorded the video in 2016 at the site of the largest niobium mine in the world, near the city of Araxá, a distance of 360 kilometers from Belo Horizonte, Minas Gerais, southeastern Brazil. The facility, built in 1955, is operated by Companhia Brasileira de Metalurgia e Mineração (CBMM), a company owned by the Moreira Salles family, the co-owners of the banking giant Itaú Unibanco. In 2011, CBMM sold a 15% stake to a group of Chinese steelmakers and a further 15% to a Japanese-South Korean joint venture, also in the steelmaking industry.

Brazil has about 98% of the world’s known reserves, followed by Canada and Australia. A survey by the National Mining Department (DNPM)—which was superseded in 2018 by the National Mining Agency (ANM)—placed Brazil’s proven reserves at 842.4 million metric tons. Of the country’s total reserves, 75% are in Araxá, 21% in noncommercial deposits in the Amazon, and 4% in Catalão, Goiás. The deposit in Goiás is operated by CMOC International Brasil, a subsidiary of China Molybdenum. The two mines combined account for 82% of global niobium production or around 120,000 metric tons (t) per year, with CBMM producing 90,000 t and CMOC around 9,000 t.

Léo Ramos Chaves

Pyrometallurgical conversion, the final stage in the production of ferroniobium

Léo Ramos Chaves “Our reserves make Brazil a strategic supplier of this commodity to the global market,” says geologist Marcelo Ribeiro Tunes, who heads the Brazilian Mining Institute (IBRAM), an advocacy organization representing the Brazilian mining industry. “The criticism that we undersell our wealth is misplaced. The price at which niobium is sold, between US$40 and US$50 a kilogram, fluctuates with market conditions. If prices are hiked in an irrational and speculative manner, customers will simply look elsewhere for options.” For comparison, a ton of iron ore is worth US$90 (or US$0.09 per kilogram) and 1 ounce (31.1 grams) of gold is traded at US$1,300—1 kilogram of the precious metal costs US$41,800, about a thousand times the price of niobium.

Marcos Stuart, head of technology at CBMM, says much of the rumors about niobium are just that. “The ore is indeed abundant in Brazil, but not uncommon elsewhere in the world. There are about 85 known deposits, most of which are not commercially exploited,” he notes. He also denies that niobium is being smuggled out of Brazil. “CBMM created a market for niobium after its discovery of the mine in Araxá. Previously, little was known about this element and its applications.”

Stuart explains that CBMM sells not the raw ore but products made from it—its flagship product being ferroniobium (FeNb), a metallic alloy composed of 65% niobium and 35% iron, used in the steel industry. “The biggest competitor to niobium is steel made without niobium,” says Stuart. Other metals, such as molybdenum and vanadium, are also used as additives to steel, although not with the same results.

Stronger steel

Adding minimal amounts of ferroniobium—approximately 0.05%—makes steel mechanically stronger without reducing its tenacity, or its ability to deform plastically without breaking. These steels, known as microalloyed steels, are used to make oil and gas pipelines, cars, ships, and bridges. Only 8% of steel products contain niobium, suggesting there is much room for growth of the market.

“Because of its added strength, steel plate made with ferroniobium can be made thinner than conventional counterparts. In the automotive industry, for example, car bodies can be lighter at no loss of strength. Weight reduction improves the efficiency of internal combustion and electric vehicles alike,” says Stuart. In pipelines, one of the more established applications, niobium prevents cracking while also allowing for thinner pipe walls. “Wall thickness can be reduced to 20 millimeters (mm), half the thickness of pipes made without ferroniobium,” he explains.

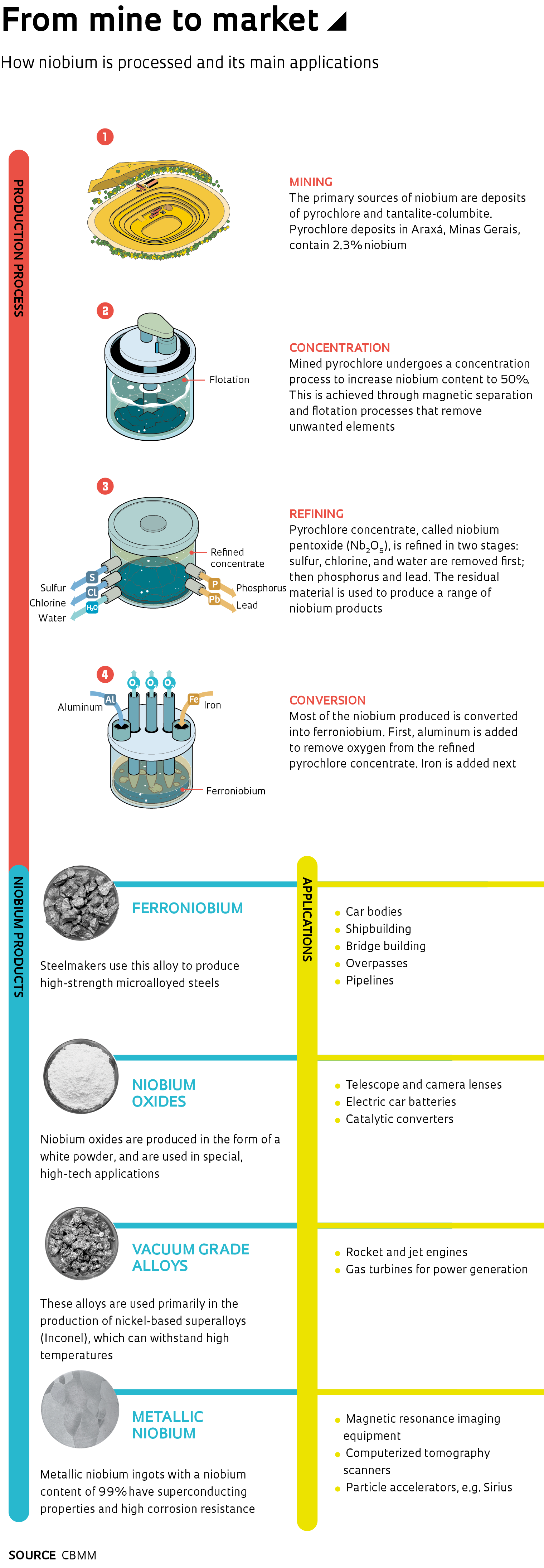

About 90% of niobium ore is processed into ferroniobium, and the remainder into products for special applications. Niobium oxides are used in the manufacture of camera lenses, electric vehicle batteries, and telescope lenses. High purity, vacuum grade niobium alloys are particularly resistant to heat, making them ideally suited for jet engines, rocket engines, and gas turbines used for power generation. Metallic niobium is used in the production of superconducting wires for computerized tomography scanners, magnetic resonance imaging equipment, and particle accelerators. Produced in the form of ingots—solid cylinders with a purity of 99%—metallic niobium has superconducting properties and high corrosion resistance.

Léo Ramos Chaves

Metallic niobium ingots from the Lorena School of Engineering (EEL) at USP

Léo Ramos Chaves CBMM is the only company in the world supplying the full range of niobium products. “From inception, CBMM has invested heavily in processes to produce ferroniobium and other niobium products,” says metallurgical engineer Fernando Gomes Landgraf, a professor in the Polytechnic School at the University of São Paulo (POLI-USP). The Araxá facility uses a 15-stage beneficiation and processing operation. The process begins with the extraction of ore from the ground. The primary sources of niobium are deposits of an ore called pyrochlore. Ore extracted from the CBMM mine contains only 2.3% niobium, which may seem little but is more than in most reserves. The remaining fraction consists of different forms of iron ore, barium oxide, and phosphate, as well as elements such as sulfur and silicon.

The Araxá mine is an excavated open-pit operation that does not require tunneling or the use of explosives. Mined ore goes to a beneficiation unit where it undergoes a concentration process to increase niobium content to 50%—this is achieved by removing undesired chemical elements present in the pyrochlore. The pyrochlore concentrate—or niobium pentoxide (Nb2O5)—is further refined and purified to produce a compound from which a variety of niobium products are then produced.

The tailings generated in the beneficiation step are stored in tailings ponds lined with high-strength plastic, mitigating the risk of soil contamination. The tailings dams were constructed using the downstream raising method, in which the dam embankment is raised in the direction of water flow. This is a safer method than upstream raising, in which each embankment raise is placed on top of the existing tailings impoundment. The failed dams owned by Vale in Brumadinho and Samarco in Mariana (both in Minas Gerais State) both used the upstream raising method, now banned in Brazil.

Léo Ramos Chaves

The Araxá mine, Minas Gerais: the world’s largest niobium operation

Léo Ramos ChavesAt current levels of consumption, the Araxá mine has a capacity to meet global demand for 200 years. Brazil’s virtual monopoly over niobium has its obvious advantages—the ore is an important source of wealth and the country’s third largest export—but also drawbacks. Physicist Rogério Cezar Cerqueira Leite, a professor emeritus at the University of Campinas (UNICAMP), says Brazil’s dominant position in the market is also an obstacle to larger-scale use of the metal. “No country or company wants over-reliance on a single supplier. And for every application for niobium, there is also a substitute, including niobium from operations in other countries which, while producing more recalcitrant ores that are more expensive to process, are already operational,” he notes.

Cerqueira Leite also points to the limited market for the metal as an obstacle to increasing consumption. “Niobium has many applications, but unfortunately for all of them demand is very limited,” says the researcher, who coauthored the book Nióbio, uma conquista nacional (Niobium, a national treasure; Duas Cidades, 1988). “Essentially, a wealth of something means nothing without a market for it. And niobium is perhaps a classic case in point. Gold costs what it does because of demand.”

Open innovation

Another constraint on international demand for niobium stems from other countries’ naturally limited interest in investing in research to find new applications for a material produced virtually only in Brazil. To get around these constraints, CBMM has established an aggressive research and development (R&D) program based on open innovation. The company invests R$150 million per year in R&D, the equivalent of 3% of its revenue of R$4.8 billion in 2017.

Léo Ramos Chaves

Quality control technicians at CBMM’s Technology Center

Léo Ramos ChavesCBMM’s Technology Center in Araxá, with a staff of 122 technicians and researchers, works to improve production processes and develop new products from niobium. It also works with external partners on research focused on new applications. “CBMM has invested across the Brazilian scientific community, funding research programs in dozens of universities and research centers. Concurrently, it supports groups in other countries with subject-matter expertise related to niobium,” says Landgraf of Poli-USP.

Internationally, the company has partnered with the University of Tokyo and the University of Okayama, in Japan; Cambridge University and the University of Sheffield, in England; and the Colorado School of Mines, in the US; among other institutions. In Brazil, CBMM has funded research at USP, the Federal University of Minas Gerais (UFMG), the Federal University of São Carlos (UFSCar), the Federal University of Viçosa (UFV), the Federal University of Ouro Preto (UFOP), the Institute for Technological Research (IPT), and the National Service for Industrial Training’s Innovation and Technology Center (CIT-SENAI) in Belo Horizonte.

It has also created collaborations with end users. One of its most recent collaborations was formed this year with Japanese conglomerate Toshiba to develop demand for niobium in the manufacture of batteries for electric cars. CBMM will invest US$7.2 million in the construction of a pilot battery manufacturing facility in Kashiwazaki, Japan, adjacent to one of Toshiba’s factories. The facility will develop a new generation of batteries containing titanium niobium oxide composite anodes. Incorporating niobium improves battery life, safety, and charging speeds, Stuart explains.

In Brazil, previously funded projects include the development of special steels for onshore pipelines in a collaboration with Brazilian oil major Petrobras, and a project with USP to develop special steels for oil and gas pipelines operating in corrosive environments. A currently ongoing project is developing improved dump trucks for the operation in Araxá. In a collaboration with a local manufacturer, the trucks’ dump bodies have been redesigned using niobium-microalloyed steel. This reduces dump body weight by 1.5 metric tons, increasing ore haulage capacity.

Another collaboration, with IPT and the Association for Children with Disabilities (AACD) in São Paulo, is researching orthopedic implants made with niobium-titanium and titanium-niobium-zirconium alloys using additive manufacturing (3D printing) methods. These biocompatible alloys exhibit high mechanical strength and high elasticity. Orthopedic implants that are too rigid can lead to bone loss around the implant. The use of niobium-titanium alloys can help to reduce this problem. The project was initiated in 2016 and has an expected duration of 42 months. Funding of R$8.2 million for the project has been provided by the São Paulo State Government, CBMM, the Brazilian Agency for Industrial Research and Innovation (EMBRAPII), and FAPESP, within the Partnership for Technological Innovation Program (PITE).

Project niobium

One of CBMM’s long-standing partnerships is with the Lorena School of Engineering (EEL) at USP, where Project Niobium—a multi-institutional initiative created in 1978—was developed to create a technological route to produce high-purity metallic niobium. The project also involved research on the various processing stages and applications for niobium and niobium alloys, with a particular focus on metallic superconductivity.

“We were the first research center to produce high-purity niobium at a pilot scale in Brazil,” recalls chemical engineer Hugo Ricardo Zschommler Sandim, a professor at EEL-USP. “CBMM supplied niobium pentoxide and we delivered high-purity ingots. Project Niobium added value to the product and allowed the commercial partner in the project to set up a vertically integrated operation.” This collaboration lasted about 10 years, until CBMM was satisfied that the technology had reached the required level of maturity and decided to develop a facility to produce metallic niobium in Araxá.

The researchers in Lorena have continued to conduct basic and applied research on niobium. “Our focus has been on developing high niobium materials, such as nickel-based superalloys and alloys for high-temperature applications. We’ve provided metallic niobium samples to more than 200 research institutions in Brazil and other countries,” says metallurgical engineer Carlos Angelo Nunes, a professor at EEL-USP. “Niobium does have exceptional properties, but much of what you see in the media is hyperbole.”

Niobium facts and figures- 98% of commercial niobium reserves are in Brazil

- 842.4 MILLION METRIC TONS: is the size of Brazil’s niobium reserves

- 8% of steel products contain niobium

- Under current market conditions, CBMM can meet global demand for 200 years

- 120,000 metric tons of niobium are produced annually

- Brazil has an 82% share of the global market

Project

Nb-Ti and Ti-Nb-Zr orthopedic prosthesis obtained through selective laser melting (nº 16/50199-6); Grant Mechanism Partnership for Technological Innovation (PITE); CBMM Collaboration; Principal Investigator Fernando José Gomes Landgraf (IPT); Investment R$1,666,137.08.

Republish