São Paulo startup MVisia specializes in artificial intelligence systems applied to industrial computer vision. PPI-Multitask, also from São Paulo, develops production management platforms known as MES, or Manufacturing Execution Systems. The two companies, whose technological solutions were funded by the FAPESP Research for Innovation in Small Businesses (RISB, or PIPE in the Portuguese acronym) program, have been recently acquired by the Brazilian multinational Weg, one of the largest global manufacturers of industrial electric motors and generators.

“The merger took MVisia to another level,” states founding partner Fernando Lopes. “We now have a commercial structure that would have taken us decades to establish. We used to have very few sellers; we now have more than 300 in Brazil and abroad. We even made our first sale in the state of Pernambuco,” sharing his excitement.

Business Focus

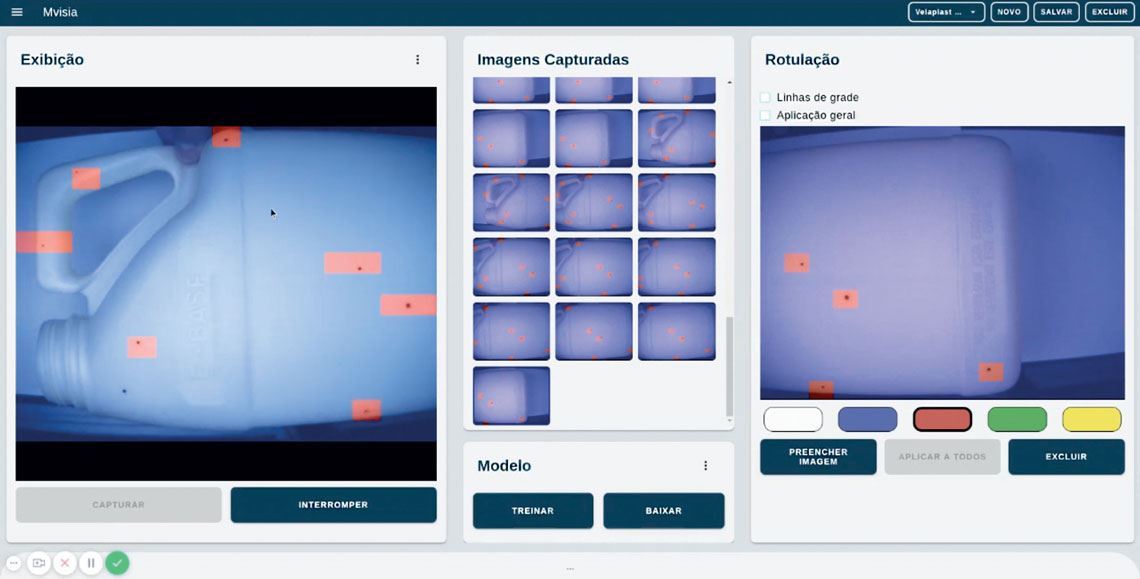

Artificial intelligence systems applied to industrial computer vision

Founded 2012

RISB projects received 4

Acquiring Company Weg

Merger Year 2020

The company was founded in 2012 at the University of São Paulo Center for Innovation, Entrepreneurship and Technology (CIETEC-USP), and its four partners agreed to transfer 51% of the shares to Weg last June. “Thanks to the partnership, we also had gains in governance, management, and financial control,” shares Lopes.

“Wow! Amazing. That was my reaction upon learning about Weg wanting to acquire our company,” recalls Marcelo Pinto, one of the three managing partners of PPI-Multitask, founded in 2000, which also sold 51% of its shares to Weg in September 2019. “We wanted to be a protagonist of industry 4.0 in Brazil. We were aware of our technical qualities, but we were also aware of our financial and operational limitations. Weg has financial power, a significant sales force, qualified management, and the same goal of being relevant in industry 4.0,” he points out.

Reproduction

MVisia: AI systems applied to industryReproductionThe interest of large corporations in the acquisition of technology-based companies, such as those funded by RISB-FAPESP, is nothing new. In 2005, the French aerospace conglomerate Thales acquired the manufacturer of satellite and radar instruments Omnisys, based in São Bernardo do Campo. In 2011, Embraer acquired São Paulo–based company Atech, focused on civil and military air traffic management, and Bradar (formerly Orbisat), specialized in the development of electronic systems and sensors, such as defense radars for land and air surveillance.

Five years later, Brazilian company Akaer, a provider of aerospace systems and components, merged with Opto Eletrônica, a São Carlos–based company specialized in optronic technology, such as that of space cameras. In 2017, the company, which is based in São José dos Campos and is part of the Gripen military jet project (see Pesquisa FAPESP issue no. 282), acquired control of Equatorial Sistemas, a developer of technological solutions for space, defense, and security systems.

Looking closely at the startup ecosystem in Brazil, corporate change of management has been widespread and growing. From January to September 2020, at least 100 startups in Brazil sold part or all of their shares, according to estimates from the innovation support platform Distrito. In 2019, this number only reached 63.

Business Focus

Industrial automation, Manufacturing Execution Systems (MES), and Internet of Things (IoT) solutions

Founded 2000

RISB project received 1

Acquiring Company Weg

Merger Year 2019

PPI-Multitask and MVisia kept their brands, teams, and headquarters in São Paulo. The founding partners are still managing their respective companies. Changes in their organizational structure include the presence of a Weg representative on the boards of both companies and the need to align them to the strategy of the corporate multinational. “Weg did not take over PPI-Multitask. We kept our operational independence, and long-term decisions are the result of a participatory governance system, in which we do have a voice,” clarifies Pinto.

Weg’s decision to acquire both PPI-Multitask and MVisia in less than a year aimed to accelerate the development of the company’s digital business division, established a year ago. Two other small technology-based companies, V2COM, from the city of São Paulo, specialized in connectivity and Internet of Things (IoT), and BirminD, from Sorocaba (São Paulo), specialized in artificial intelligence applied to industrial data analysis, were also bought by Weg for the same purpose.

“These are companies that add value to our portfolio of digital solutions with mature and tested technologies,” recognizes Carlos Bastos Grillo, digital business director at Weg, whose headquarters are in Jaraguá do Sul, in Santa Catarina. “The sharing of knowledge and resources between Weg and these four companies generates new opportunities for innovation and helps offer more complete solutions to customers.”

VM / Getty Images

The startup PPI-Multitask supporting operations on the factory floorVM / Getty ImagesInnovation experts estimate that mergers, acquisitions, and other forms of interaction between large companies and innovative newcomers will become increasingly common in Brazil—much like they already occur intensely in the United States—and that is good news. “It is key that entrepreneurs have several opportunities to obtain a return on their efforts, financial or otherwise. This strengthens the innovation ecosystem,” highlights food engineer Luciana Hashiba, deputy coordinator of the Innovation Center at the São Paulo School of Business Administration at the Getulio Vargas Foundation (FGV-EAESP).

Chemical engineer Américo Craveiro, deputy coordinator of Innovation Research of the Scientific Board of FAPESP, stated that the fact that large groups are interested in small, innovative businesses is a measure of the success of RISB. “It means that entrepreneurs who have received support have passed technical challenges and been able to validate their proposals,” he states.

Hashiba—who is also part of the deputy coordinator’s team—and Craveiro both believe it does not matter that the product whose development was funded by the public innovation-promoting program is not sold by its inventor, but by third parties, or even that the companies have been sold. “What matters is that they never give up on the difficult path of transforming an idea into a successful enterprise,” ponders Hashiba. “It is the final result that counts. Funding for technology should generate value for society and ensure economic and social returns on investment,” argues Craveiro.

According to César Costa, managing partner of the entrepreneurship and corporate innovation consultancy company Semente Negócios, what motivates large corporations to acquire startups is the desire to accelerate a specific corporate strategy. “It may be looking to enter new markets, diversify its product portfolio, incorporate new technologies, or even attract talent,” he explains.

During a traditional merger, what is most often at stake is market share, a successful product, or the physical structure of the acquired company. In a startup, the main asset is usually the innovative capacity of the entrepreneurs.

The fact that large corporations are interested in small, innovative businesses is a measure of the success of RISB

According to Costa, one of the greatest challenges in acquiring an innovative newcomer is keeping the knowledge and momentum of the founders. “It is not unusual for acquisition contracts to include clauses establishing that the entrepreneurs remain working at the startup for some time, preventing their departure from negatively impacting the business,” reports the consultant.

Production engineer Eduardo Zancul, from the Polytechnic School of the University of São Paulo and a member of the FAPESP deputy coordinator’s office, highlights the challenges faced by a small company looking to establish itself. “A severe crisis or changes in the competitive parameters can affect or even compromise its survival. Small companies are fragile and unstable,” he states.

This applies even more in a country like Brazil, where private credit is historically expensive and the annual economic growth variation is abrupt, making business planning difficult. Over the last two decades, Brazil has mixed 10 years of modest growth, six years of significant economic evolution, of 4% or more, and another four years of recession—2009, 2015, 2016, and the first half of 2020—according to the annual calculations of the Gross Domestic Product (GDP) by the Brazilian Institute of Geography and Statistics (IBGE). This year, the Institute for Applied Economic Research (IPEA) projects a 5% decline in the GDP.

“Companies want to grow in search of more stability. Growth demands capital, knowledge, access to distribution, and customers. A small company on its own can take a long time to achieve this,” says Zancul. There are few alternatives to accelerate this process, according to the researcher. One is for entrepreneurs to seek investors. Another is merging with other small companies in an effort to form a larger business. The third is selling the company. “Being bought by another group can also be a path toward growth for small businesses.”

Business Focus

In vitro fertilization of bovine embryos

Founded 2002

RISB projects received 4

Acquiring Company ABS Global

Merger Year 2015

Fertilization Success

InVitro Brasil (IVB), of Mogi Mirim, in the state of São Paulo, was founded in 2002 and has achieved significant market success. Before being sold in 2015 to the genetics company ABS Global, which belongs to the North American group Genus, it was already the largest bovine in vitro fertilization company in the world—in 2013, it was responsible for 45% of global embryos produced—and a pioneer in cryopreservation, or embryo freezing, a technology developed with support from RISB (see Pesquisa FAPESP issue no. 231).

“We were market leaders for in vitro fertilization. However, we were too small to compete with the genetics giants in the breeding market,” explains veterinarian José Henrique Pontes, founding partner of IVB and current global director of Embryo Strategy at ABS.

Pontes states that the capacity of Genus to invest in research was a decisive factor in the purchase. “The group invests over US$50 million annually in research, and a significant amount is directed to biotechnology and in vitro fertilization,” he highlights. Until they acquired IVB, ABS Global specialized in artificial insemination with an advanced sex-based semen separation technique, allowing breeders to choose the sex of the animal.

Camila Zanitti de Oliveira / InVitro Brasil

InVitro researcher cultivates a bovine embryo in a laboratoryCamila Zanitti de Oliveira / InVitro Brasil“The acquisition of an embryo-focused company, like IVB, was the missing link for a complete portfolio,” says Márcio Nery, general director of ABS Brazil. “Frozen embryo technology is the future, and it was a deciding factor for the group’s interest in IVB.” ABS has six laboratories in the United States, one in Mexico, and three in Brazil. Nery explains that the Brazilian technicians are responsible for international experimental laboratory projects on embryos. “We have teams in Russia, Vietnam, and Chile. We may also start operating in India,” he shares. ABS Brasil currently employs 120 Brazilian embryo technicians, which is double the original IVB team in 2015.

Consultant César Costa, from Semente Negócios, points out a common practice in the market: the partial acquisition of a startup, keeping the original entrepreneurs interested in the success of the company and establishing governance models that allow for autonomy in decision making. Often, the startup manager reports directly to the CEO or to the board of the new controlling business.

Business Focus

Data analysis and urban mobility solutions

Founded 2014

PIPE projects received 3

Acquiring Company green4T

Merger Year 2019

This is what happened with São Paulo–based startup Scipopulis, specialized in data analysis and urban mobility solutions, acquired by green4T in 2019. “We had no interest in transforming Scipopulis into green4T, but in keeping their innovative culture,” says Eduardo Marini, CEO of green4T, a Brazilian technology and digital infrastructure solutions company based in São Paulo. “In one of the first rounds of negotiations, we made a point of ensuring that they would keep their brand and operational independence. They would not have an outsider boss giving orders,” recalls Marini. Another concern, he points out, was creating a welcoming environment for the new, 10-person team.

“We definitely were afraid of becoming bureaucrats and carrying out orders. What defined the merger was the alignment of purposes,” shares Roberto Speicys, one of the four founding partners of Scipopulis. The agreement defined that, with the merger, the startup’s founders would hold green4T shares and Speicys would remain as CEO of Scipopulis. All the startup founders were in favor of the merger, but two of them moved on to new ventures.

Marini believes the acquisition of Scipopulis was an opportunity for green4T to expand its solution portfolio. The startup was founded in 2014, and PIPE’s funding was essential for its development of two solutions: the app Coletivo, which shares live data about buses and public transportation, and the web panel for bus fleet monitoring and managing Trancity, aimed at fleet managers and city managers.

For now, these solutions are only available in the city of São Paulo. “Startups have a difficult time participating in public tenders and negotiating with city managers. But green4T has some expertise in this,” recognizes Speicys. The Trancity platform has already been implemented in Belo Horizonte, Rio de Janeiro, Teresina, Fortaleza, and Santiago, Chile. The new perspectives are not restricted to the transportation sector. “Our business is developing technological solutions based on data analysis. We are considering going into health care, public security, and other urban mobility applications,” reveals Speicys. “Being part of the green4T portfolio will undoubtedly help us accelerate these new projects.”

Projects

1. Technical-scientific feasibility assessment of a computer vision system for classifying seedlings of flower and ornamental plants (no. 12/50974-9); Grant Mechanism Research for Innovation in Small Businesses (RISB) program; Principal Investigator Luiz Otávio Lamardo Alves Silva (MVisia); Investment R$61,818.93.

2. Development of forestry seedling inspection & quality control machines (no. 15/08706-5); Grant Mechanism Research for Innovation in Small Businesses (RISB) program; Agreement FINEP RISB/PAPPE Grant; Principal Investigator Fernando Antonio Torres Velloso da Silva Neto (MVisia); Investment R$306,930.85.

3. Development of computer vision and artificial intelligence-enabled machine for selection of sugar cane seedlings (no. 17/07731-1); Grant Mechanism Research for Innovation in Small Businesses (RISB) program; Agreement FINEP RISB/PAPPE Grant; Principal Investigator Fernando Paes Lopes (MVisia); Investment R$231,763.32.

4. Feasibility assessment of on-board computer vision system for identification of poultry carcasses with potential contamination (no. 18/13213-6); Grant Mechanism Research for Innovation in Small Businesses (RISB) program; Principal Investigator Fernando Antonio Torres Velloso da Silva Neto (MVisia); Investment R$52,683.80.

5. Development of a MES (Manufacturing Execution System) system to support manufacturing companies in meeting the new demands of industry 4.0 (no. 17/00959-7); Grant Mechanism Research for Innovation in Small Businesses (RISB) program; Principal Investigator Claudio Vinicius Buonamici (PPI- Multitask); Investment R$367,333.80.

6. Evaluation of mass spectrometry for bovine in vitro production media and fetal calf serum quality control (no. 07/01400-1); Grant Mechanism Research for Innovation in Small Businesses (RISB) program; Principal Investigator Christina Ramires Ferreira (InVitro Brasil); Investment R$130,529.18.

7. Development of genomic tools for selection of breed cows presenting high fertility (no. 12/51067-5); Grant Mechanism Research for Innovation in Small Businesses (RISB) program; Principal Investigator Andrea Cristina Basso (InVitro Brasil); Investment R$236,162.20.

8. Validation of biopsies and amplification of DNA from bovine embryos produced in vitro for whole genome analysis (no. 14/50616-0); Grant Mechanism Research for Innovation in Small Businesses (RISB) program; Principal Investigator Andrea Cristina Basso (InVitro Brasil); Investment R$125,163.46.

9. Standardization and validation of real-time PCR for sanitary certification of bovine embryos produced in vitro (no. 14/50169-4); Grant Mechanism Research for Innovation in Small Businesses (RISB) program; Principal Investigator Juliana Hayashi Tannura (InVitro Brasil); Investment R$114,622.70.

10. Crowdsourcing App for Obtaining Real-Time Information on Public Transportation Systems (no. 13/50812-1); Grant Mechanism Research for Innovation in Small Businesses (RISB) program; Principal Investigator Roberto Speicys Cardoso (Scipopulis); Investment R$468,892.75.

11. Development of a Crowdsourcing App and Related Data Analytics for Providing Real-Time Information on Public Transportation Systems (no. 15/50343-7); Grant Mechanism Research for Innovation in Small Businesses (RISB) program; Principal Investigator Roberto Speicys Cardoso (Scipopulis); Investment R$778,840.10.

12. A Crowdsourcing Platform Providing Real-Time Information on Public Transportation Systems (no. 15/50572-6); Grant Mechanism Research for Innovation in Small Businesses (RISB) program; Principal Investigator Márcio Calixto Cabral (Scipopulis); Investment R$479,175.47.