Léo RamosThere is one segment of the Brazilian economy that is growing at “Chinese” rates (10.8% in 2012). This segment is increasingly concentrated in São Paulo State (where 48.5% of the companies that operate in this sector in Brazil are located, versus 44.3% in 2008). They employ highly skilled workers (47.4% have bachelor’s and master’s degrees, as opposed to the labor market average of 18.8% in São Paulo State). We are referring to the software, information technology and communications sector, as illustrated by a study launched in May by the Data Analysis System Foundation (Fundação Sistema Estadual de Análise de Dados), or Seade.

Léo RamosThere is one segment of the Brazilian economy that is growing at “Chinese” rates (10.8% in 2012). This segment is increasingly concentrated in São Paulo State (where 48.5% of the companies that operate in this sector in Brazil are located, versus 44.3% in 2008). They employ highly skilled workers (47.4% have bachelor’s and master’s degrees, as opposed to the labor market average of 18.8% in São Paulo State). We are referring to the software, information technology and communications sector, as illustrated by a study launched in May by the Data Analysis System Foundation (Fundação Sistema Estadual de Análise de Dados), or Seade.

Coordinated by researchers Alda Regina Ferreira de Araújo and Cássia Chrispiniano Adduci, the work involves a new and different mapping effort of the distribution of companies in the segment by municipality in São Paulo State, and it shows a major change between 2008 and 2012. New hubs sprang up and others became specialized, yet the state capital continues to be an influential hub (see infographic). “We are interested in understanding this segment better, with its intensive research and development, due to its dynamic nature and innovativeness and its strategic position in fostering the economic development of the state,” Alda Ferreira says.

The research also shows recent efforts to train professionals capable of meeting this sector’s needs; in the public institutions of São Paulo alone, openings in various computing and telecommunications courses in the period the research covered increased 93%, and the figure is 32% for the private institutions. In addition, the research reveals the problems this course of study is experiencing, such as students dropping out. “The idea is to highlight possibilities for studies that move the discussion ahead on training professionals for the sector and that can be useful in the preparation of public policies to tackle this challenge,” Adduci explains.

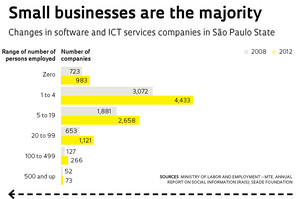

The Brazilian information technology and communications market is the fourth largest in the world, after the United States, China and Japan, with sales figures of more than $230 billion in 2012. “Brazil has been unable to become a global player in the segment, which is led by the United States, Japan, Germany, Korea and China. However, the demand for products and services in all kinds of companies is buoyant, and this explains the growth,” according to Ferreira. The study shows that the segment has certain characteristics in São Paulo State. There is a heavy concentration in a group of 15 municipalities, where 70% of the companies and 87% of the jobs are located. The cities are Americana, Barueri, Bauru, Campinas, Hortolândia, Jaguariúna, Jundiaí, Mogi das Cruzes, Osasco, Poá, Ribeirão Preto, Santana de Parnaíba, Santo André, São José dos Campos and São Paulo. Another feature is the predominance of microenterprises and small businesses, which account for 85% of the nearly 9,500 companies with up to 20 employees. Among the municipalities selected in the study, the state capital, where 61% of the jobs and 72% of the companies are concentrated, distinguishes itself in two areas: companies that develop custom software and information technology consulting firms.

The Brazilian information technology and communications market is the fourth largest in the world, after the United States, China and Japan, with sales figures of more than $230 billion in 2012. “Brazil has been unable to become a global player in the segment, which is led by the United States, Japan, Germany, Korea and China. However, the demand for products and services in all kinds of companies is buoyant, and this explains the growth,” according to Ferreira. The study shows that the segment has certain characteristics in São Paulo State. There is a heavy concentration in a group of 15 municipalities, where 70% of the companies and 87% of the jobs are located. The cities are Americana, Barueri, Bauru, Campinas, Hortolândia, Jaguariúna, Jundiaí, Mogi das Cruzes, Osasco, Poá, Ribeirão Preto, Santana de Parnaíba, Santo André, São José dos Campos and São Paulo. Another feature is the predominance of microenterprises and small businesses, which account for 85% of the nearly 9,500 companies with up to 20 employees. Among the municipalities selected in the study, the state capital, where 61% of the jobs and 72% of the companies are concentrated, distinguishes itself in two areas: companies that develop custom software and information technology consulting firms.

The importance of the São Paulo city software hub is also evidenced by the size of the businesses located there: of the 25 companies with more than 500 employees located in the state, 19 are in the city of São Paulo. “This profile of the capital city is well known,” says Virginia Duarte, manager of the observatory of the Association for the Promotion of Excellence of Brazilian Software (Associação para Promoção da Excelência do Software Brasileiro – Softex). According to Duarte, this profile was in large part generated by the demands of the financial market, which stopped producing software and instead outsourced the work to companies. “Information technology consulting firms help to identify the features of the programs clients need. And custom software companies are in charge of the codification component for the products that are requested,” she explains. There is a simple explanation for the concentration of robust businesses in São Paulo, Duarte notes: The ones that are growing the most eventually move to São Paulo, with its sizeable consumer market.

New hubs

The capital city of São Paulo State, the study shows, offers a set of services that are important for the operation of businesses that create, market and distribute products. São Paulo also has good transportation, telecommunications and information technology infrastructure, in addition to skilled workers. “Furthermore, there is a substantial network of vocational schools and many institutions of higher learning, some of which are internationally recognized, as well as production research centers and laboratories that are knowledgeable in a myriad of fields,” according to the Seade Foundation study. With the concentration in the capital city of São Paulo, some types of businesses have moved outside the city limits, creating new hubs. Thanks to tax policies, the neighboring cities of Barueri and Santana de Parnaíba stand out because they are home to data processing companies, Internet providers and hosting firms that require infrastructure and space, but they do not need to be in densely urbanized areas.

The second largest software, information technology and communications hub is in the Metropolitan Campinas Region. This process began in the 1970s with the opening of the IBM computer factory in Sumaré and the Telebras Center for Research and Development in Telecommunications (Centro de Pesquisa e Desenvolvimento em Telecomunicações –CPqD) in Campinas. Even back then, they reaped the benefits of the research done at the University of Campinas (Unicamp) and the professionals who were trained by this institution. Campinas is the birthplace of firms such as CI&T (see Pesquisa FAPESP Issue No. 220), founded by Unicamp alumni almost 20 years ago and CI&T has operations in many countries today. The analysis of the jobs created in the software segment in the region between 2008 and 2012 shows how Campinas is thriving as a hub for custom software development as well as customizable programs that can be tailored to the specific customer’s needs. Large businesses that specialize in the development of custom computer programs, located in Jaguariúna and Americana, in addition to the firms in the municipality of Campinas, make up the second largest contingent of employees who work in this sector in São Paulo State.

The second largest software, information technology and communications hub is in the Metropolitan Campinas Region. This process began in the 1970s with the opening of the IBM computer factory in Sumaré and the Telebras Center for Research and Development in Telecommunications (Centro de Pesquisa e Desenvolvimento em Telecomunicações –CPqD) in Campinas. Even back then, they reaped the benefits of the research done at the University of Campinas (Unicamp) and the professionals who were trained by this institution. Campinas is the birthplace of firms such as CI&T (see Pesquisa FAPESP Issue No. 220), founded by Unicamp alumni almost 20 years ago and CI&T has operations in many countries today. The analysis of the jobs created in the software segment in the region between 2008 and 2012 shows how Campinas is thriving as a hub for custom software development as well as customizable programs that can be tailored to the specific customer’s needs. Large businesses that specialize in the development of custom computer programs, located in Jaguariúna and Americana, in addition to the firms in the municipality of Campinas, make up the second largest contingent of employees who work in this sector in São Paulo State.

Although very recent, the establishment of technology parks in São José dos Campos and Ribeirão Preto has already begun to boost the number of jobs in both cities in information technology companies. According to the study, these two emerging hubs are new frontiers for the segment in the state.

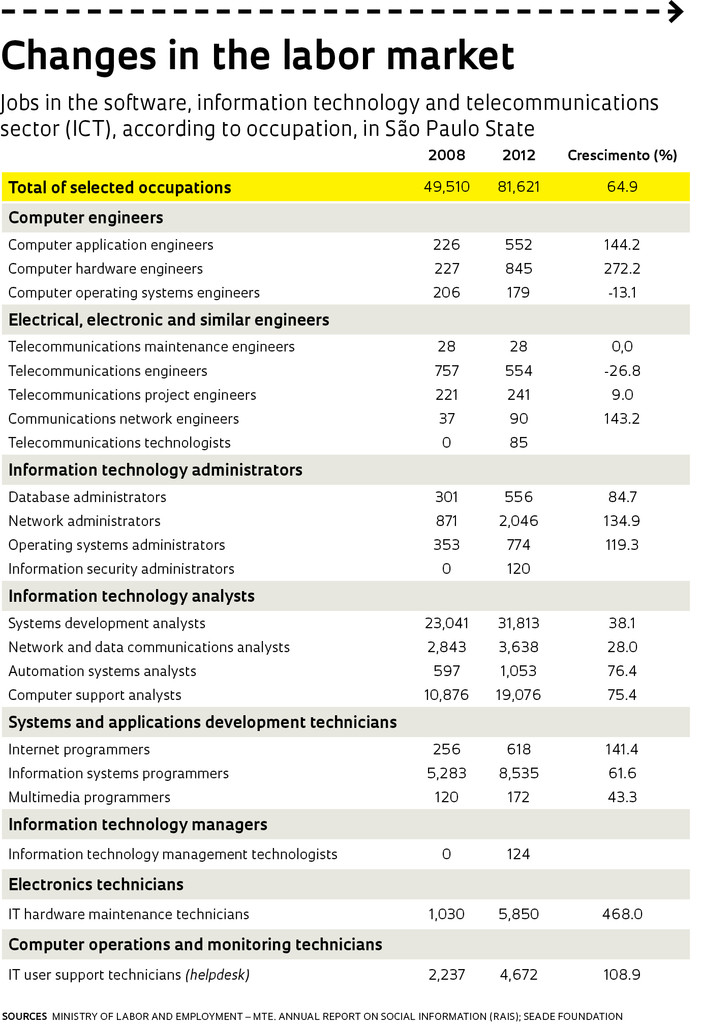

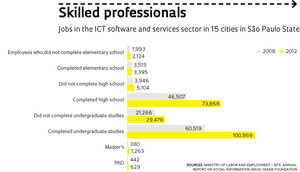

One of the characteristics of software, information technology and telecommunications companies is that they rely on highly skilled labor. Nearly half of the employees of these businesses have an undergraduate or graduate degree – compared to the state average of nearly 19%. Between 2008 and 2012, the strong point was the considerable increase in jobs held by professionals with undergraduate degrees, which jumped from 60,519 in 2008 to 100,869 in 2012. Positions occupied by master’s degree holders soared from 380 to 1,263, for a growth rate of 232.4% in the selected municipalities. The number of jobs held by PhDs rose from 442 to 629, or 42.3%, which was slower than the growth rate in the entire state. “The segment is not labor-intensive, but it does require a growing number of highly skilled professionals,” says researcher Alda Ferreira.

Systems analysis

Systems analysis

To meet a growing demand for professionals, the number of openings in university courses (such as network administration, computer sciences and Internet use, to name a few) grew by 37% in São Paulo State (from 66,259 to 90,952 openings between 2008 and 2012). The main highlights were the higher number of vacancies in systems analysis and development courses and the effort made by the public institutions and universities, which almost doubled available openings during the period. But the study also found that more and more students are dropping out. Again, in systems analysis and development courses, the number of graduates rose by 27.6%, less than the increase in the number of enrollments and available openings, which was 43%. “These courses of study require strong performance in logical reasoning and mathematics, in addition to fluency in English. Finding these skills in a large number of college applicants is no easy task,” Adduci notes about the dropout situation.

The data corroborate the perception of a recent Softex study of the labor market and labor training in information technology. The study indicates that there is an imbalance in the distribution of openings in college-level courses in the computing field in Brazil – a result of the concentration of firms in certain regions and the fact that the courses are scattered throughout the country. In addition, a higher dropout rate threatens the ability of companies to grow.

According to the study, the reasons for the 20% dropout rate for computing and IT courses range from frustration with course content to the ability to access the labor market without a degree, as well as training issues that negatively impact student performance.

The dropout situation may cause the problem of shortages of professionals to become chronic (today it is restricted to a few areas and regions). A simulation by Softex forecasts a shortfall of 408,000 professionals in 2022. If this happens, Softex estimates a loss of $140 billion for the segment by 2022. Another challenge is the quality of the professionals. “The students from public universities and institutions of higher learning in Brazil are more qualified than the students from private schools,” Duarte notes. According to the Softex study, just 43% of employers state that they find recent graduates from university programs or technical programs that have the profile their jobs require.

The professionals who are needed to guarantee the growth of information technology are at the top of Brazil’s priorities. US President Barak Obama set as one of the top priorities for his administration the improvement of education in the sciences, engineering, technology and mathematics to ensure the economy’s competitiveness. Businesses in the sector frequently pressure Obama to lower barriers to importing skilled workers from other countries.

Republish