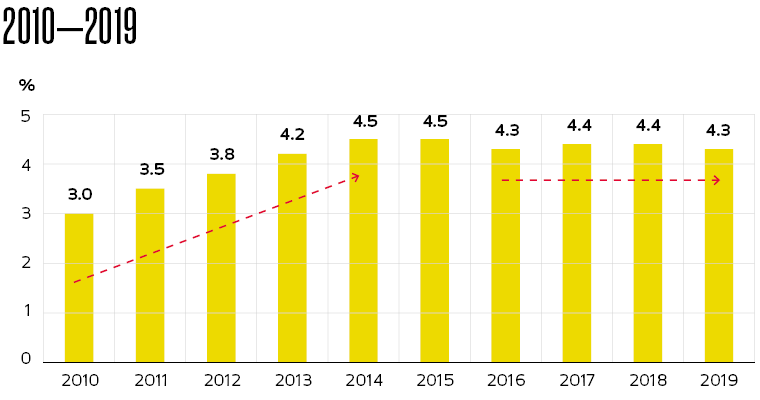

- Companies and organizations are often offered tax exemptions as an incentive to carry out certain practices in the public interest. This strategy can potentially lead to revenue losses, the estimates of which are known as tax expenditures1. Tax expenditure levels in relation to Brazilian GDP over the last decade showed a significant increase until 2014, followed by relative stability in more recent years

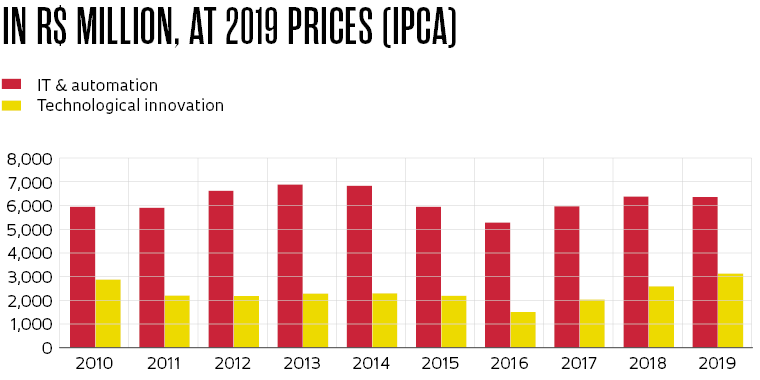

- Tax incentives designed to stimulate corporate RDI in the country are established directly in the “Lei do Bem”2 and as a counterpart requirement in the “Lei de Informática”3. In 2019, tax expenditures resulting from these incentives accounted for 3.1% of the total, or 0.12% of GDP. These percentages are lower than recorded in 2010 (4.5% and 0.14%, respectively)

- Tax expenditures from the Lei do Bem, systematically lower than those of the Lei de Informática, declined in significance between 2010 and 2017, a trend that was only reversed in 2018 and 2019

Notes (1) Because revenue losses from tax incentives cannot be observed directly, they are measured using counterfactual assumptions, e.g., hypotheses and criteria to estimate the amount that could have been collected in the absence of said tax incentives. (2) Law No. 11.196/2005 (3) Law No. 8.248/1991 and its amendments

Sources Brazilian Federal Revenue and IBGE, IPCA historical series

Republish