In the final pages of The General Theory of Employment, Interest and Money, published in 1936, British economist John Maynard Keynes (1883–1946) writes that “Practical men who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist.” What happens, however, when someone with intellectual influences and ideas about production, consumption, and trade is brought into a position where he must conduct a country’s economic policy?

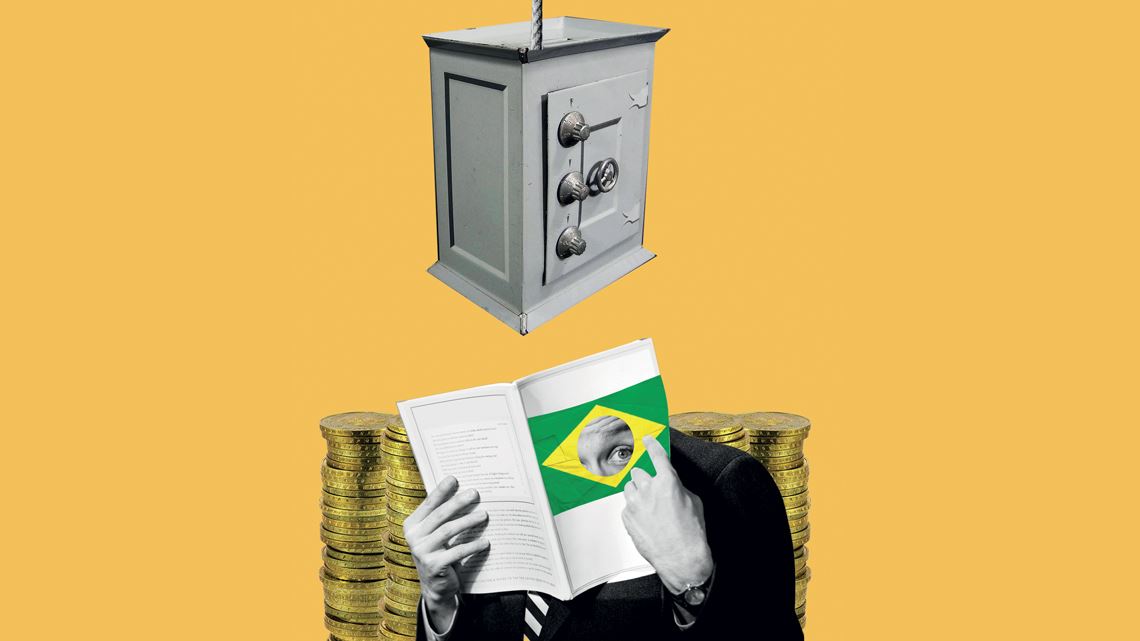

The not-always harmonious meeting of economic ideas with political and social realities is one of the central themes of Os homens do cofre: O que pensavam os ministros da Fazenda do Brasil republicano (1889-1985) (The safe men: What the finance ministers of Republican Brazil [1889–1985] were thinking), edited by Ivan Colangelo Salomão, of the Department of Economics at the Federal University of Paraná (UFPR). The book’s 17 chapters examine the intellectual and professional trajectory of the principal executives of the Ministry of Finance, from the proclamation of the Republic in 1889 through the end of the military dictatorship (1964–1985). The book is the first volume to be published in a trilogy that will shed light on the role of Brazil’s finance ministers, beginning with the nation’s Independence in 1822, until 2016.

Salomão says he was working on another project, dedicated to Brazilian economic thinkers of the nineteenth century, when he realized that none of the figures he was studying had been directly responsible for economic policy. “Hence the idea of a book about finance ministers: how do the actions these people took connect with their way of thinking?” recalls the economist.

“Finance ministers are people who deal directly with policy on a daily basis, which is why they’re always confronted with the tension between theory and reality,” observes Alexandre Macchione Saes, from the Department of Economics at the School of Economics, Administration, and Accounting at the University of São Paulo (FEA-USP), who coauthored two chapters of the book. “Practically everything that was thought about economics during the history of Brazil was based on practical problems, linked to the country’s ongoing development. It makes sense to examine the history of economic thought in Brazil through these figures.”

The focus on the Ministry of Finance (replaced in 2019 by the current Ministry of the Economy) is also justified by the fact that the position was held by some famous individuals along the country’s historical path. These included the legal scholar Ruy Barbosa (1849–1923), better known for his parliamentary and diplomatic career, and the future president, dictator, and president-elect Getúlio Vargas (1882–1954), who served in the same First Brazilian Republic he was to overthrow a few years later.

Research in the history of economic thought has seen significant growth over the last two decades

A heavy ministry

Brazil has experienced a troubled economic history, with persistent inflation, cycles of recession, and debt moratoria. Many ministers spent almost their entire terms fighting crises. The most recent minister to occupy the position portrayed in this volume, economist Ernane Galvêas, told the authors of the chapter dedicated to him that “there was no time to think and formulate an economic policy. Every day we had to put out some kind of fire; we were stuck in the short term,” recounts Victor Cruz e Silva, from the Institute of Economics and International Relations at the Federal University of Uberlândia (IERI-UFU), and coauthor of two chapters. The Galvêas administration, from 1980 to 1985, coincided with the end of a period of accelerated growth in Brazil.

The country’s turbulent economic trajectory made the Ministry of Finance a key institution in the construction of Brazil. Its creation predates Independence: the first finance minister, under the then king, Dom João VI (1767–1826), was the Count of Aguiar, Dom Fernando José de Portugal e Castro (1752–1817), who took office in 1808, the year the Portuguese court arrived in Brazil. From 1822 on, responsible for the finances of a young nation that needed to pay compensation to Portugal for formal recognition, borrow gold to buy products from abroad, and guarantee the profitability of agricultural exports, Brazil’s finance ministers became particularly important figures.

This is a characteristic that Brazil shares with some of its neighbors, such as Argentina, Colombia, Peru, and Mexico, according to Salomão. “But in these countries, the history of the Ministry of Finance has already been studied, analyzed, and told countless times. Here, there are still few publications on the subject,” he says. Other countries do not confer so much importance and autonomy to their ministers in the economic arena. Salomão compares Brazil with the United States, where the corresponding officeholder, that of the Secretary of the Treasury, has much less power to decide the country’s economic policy. “One reason is that the Federal Reserve has been independent for a long time and has autonomy, legally and in practice. So the U.S. Treasury secretary has no say over a very important instrument, monetary policy. In Brazil, ministers like Delfim Netto, the most powerful we’ve ever had, could simply seat someone they trust in the Central Bank’s presidency,” he observes.

During the imperial era, it was common for great political figures to occupy both the Ministry of Finance and the presidency of the Cabinet, a position corresponding to that of prime minister. The era of the so-called “economy czars,” individuals with great political power thanks to their positions as minister, was effectively inaugurated during the Republican Period, with Ruy Barbosa and Joaquim Murtinho (1848–1911), says Salomão.

“In Brazil, presidents who didn’t understand or weren’t interested in economics delegated this role to their ministers, for example, as [Emílio Garrastazu] Médici [1905–1985] did with Delfim,” observes Salomão. “On the other hand, presidents with strong economic views had less significant ministers. Some were even forgotten. The Brazilian finance minister with the most longevity at the helm was Artur de Souza Costa [1893–1957], who held the post from 1934 to 1945. But few are able to cite his name, because he was minister under Vargas, who was the one who really ran his economic policy.”

In the twentieth century, the job description grew, with Brazil’s efforts at industrialization demanding the founding of new institutions and the development of new financial instruments. During this period, finance ministers were directly responsible for creating the Central Bank, which dates back to 1964 and was preceded by the Superintendency of Currency and Credit (SUMOC), formed in 1945; the Brazilian Development Bank (BNDES), in 1952; the Housing Finance System (SFH), in 1964, and other institutions.

“In the time of [Francisco de Paula] Rodrigues Alves [1848–1919], creating economic policy basically entailed managing the exchange rate, and taking a few other measures here and there. He was very restricted,” Salomão says, referring to the lawyer who was Minister of Finance between 1891 and 1892 and later president of the Republic (1902–1906). “By the era of [Mario Henrique] Simonsen [1935–1997], minister from 1974 to 1979, there were many more instruments and institutions. In the 1960s and ’70s, the inflation problem was at another level. The conditions were completely different than at the beginning of the twentieth century,” he adds.

In Brazil, research on the history of economic thought has grown significantly over the last two decades, with an emphasis on the rapid development of studies on how theories were assimilated, adapted, or produced in the country, says Saes, from FEA-USP. In this subfield, one of the recurrent questions concerns the existence of doctrines that emerged or developed in Brazil, but which have universal applications.

Conditions under which Brazilian finances were administered didn’t correspond to the theories formulated in more advanced nations

Historians believe that over the last century, Brazilian theorists played a fundamental role in two currents of economic thought that fit this description. The first, developed during the 1940s and ’50s, is the structuralism associated with ECLAC (Economic Commission for Latin America and the Caribbean), with its theory of deteriorating terms of trade, whose chief architects were Raúl Prebisch (1901–1986) of Argentina, and Brazil’s Celso Furtado (1920–2004). The second is the theory of inertial inflation, developed in the 1980s by economists such as André Lara Resende, Francisco Lopes, and Persio Arida, which was a central tenet of what would become the Plano Real, implemented in 1994. Although their points of departure were issues specific to Brazil, these doctrines apply to situations that are not limited to one country.

Excluding these two cases, explains Saes, “the economic thinking that developed here was almost always a response to practical questions faced by people in academia, the market, or government.” “This is how the themes of industrialization, the balance of payments, poverty and inequality, and the structure of an agrarian, exporting country emerge. These problems were confronted using interpretation models imported from industrialized economies with very different economic structures,” he adds.

Salomão points out that because the conditions under which Brazilian finances and the country’s productive sectors were managed never perfectly corresponded to what the theories developed in more advanced nations prescribed, there was always a need to “tropicalize” economic ideas and principles. During the nineteenth century, one of the first “victims of tropicalization” was the gold standard, the system upon which the relative value of the world’s currency throughout the nineteenth century—and part of the twentieth—was founded. Under this system, the amount of currency in circulation should correspond to the gold that the country has in its reserves, according to a previously fixed rate. “The gold standard was an impossible reality to maintain for a country with a highly deficit balance of payments. It was a rule that, practically, was not to be followed. The exchange rate was stipulated in 1846, but it was always an exception,” adds Salomão.

Referring to Eugênio Gudin Filho (1886–1986), Cruz e Silva notes that Gudin’s experience as minister “showed him that forces outside the textbook are sometimes too great to be ignored.” Pressured by the conditions under the government of President Café Filho (1899–1970), who took office after Vargas’ suicide, Gudin, the economist who vigorously defended the free market had to accept measures of state intervention in the economy. “In the textbook, the economic system appears as an island separate from everything else that happens in society. From the moment someone assumes the role of policy maker they must deal with social interactions, which transcend the economic system. Then the question becomes: what is the limit of what he will accept? Where does he draw the line for what he will no longer be a part of?” asks Cruz e Silva. In Gudin’s case, pressure against his anti-inflationary policy led him to resign.

Ruy Barbosa, the Republic of Brazil’s first minister of finance, was a “liberal intellectual” and a “heterodox politician,” writes Salomão. His ideas about production and trade were strongly based on classical economic policy, particularly on British philosopher and economist Adam Smith (1723–1790), one of the fathers of economic liberalism. Barbosa had a great admiration for England and argued that the country’s power was based, to a large extent, on its liberal practices. However, upon taking office, “his policy was one of intervention, defense of national production, and expansionist monetary policy,” points out Salomão. “He said that a revolutionary government cannot be parsimonious and conservative.” Barbosa believed the Empire had been responsible for the country’s political consolidation and the Republic would be responsible for its economic transformation.

Something similar occurred in the case of legal scholar Horácio Lafer (1900–1965), who was minister during the last Vargas government (1951–1954). According to Saes, in the traditional history of Brazilian economics, Lafer is seen as a “balance scale” in the government, that is, someone who would “pull” the policies of a regime characterized by state intervention in the direction of liberalism. The FEA-USP professor disagrees with this interpretation. Lafer was educated during a generation of thinkers who orbited the sphere of influence of Roberto Simonsen (1889–1948), “a generation linked to industrialization, which sees industrial growth as coming through the state, with an explicitly Brazilian project,” counters the historian.

Before taking office as finance minister, Lafer had been a “class representative” (an early type of parliamentarian elected to represent one of various business sectors). He agreed with the ideas drawn up in the Carta de Teresópolis [the Teresópolis Letter, a kind of manifesto to the nation] drawn up at the end of the Congress of the Producer Classes, in 1945, held in Teresópolis, Rio de Janeiro. The letter advocated that the state combat poverty directly, promote education, and incentivize industrialization. “In fact, Horácio Lafer implemented a policy to clean up public accounts and had defended fiscal balance since the 1930s. He said: ‘We can’t lose to inflation,’” says Saes. Hence, in practice the measures he took leaned towards the side of economic liberalism. “But this philosophy had as its long-range goal the creation of mechanisms to make growth and industry viable, in alignment with the Vargas project,” counters Saes.

The development of economic institutions and policies took place in parallel with the implementation and expansion of economics programs at Brazilian universities. The first chairs dedicated to the subject emerged in the 1830s, in the country’s first two law schools, in São Paulo and Olinda, Pernambuco, and, shortly after, in engineering schools—beginning in Rio de Janeiro. They were courses taught during the final years of graduation, based on canonical texts, such as those of British economists David Ricardo (1772–1823) and John Stuart Mill (1806–1873), says Salomão, from UFPR. Schools of Economics were only created beginning in the 1940s. The first two were the National School of Economic Sciences, in Rio, at the University of Brazil, now the Federal University of Rio de Janeiro (UFRJ), and at the University of São Paulo (USP).

Until then, comments Cruz e Silva, economists and, by extension, finance ministers, were graduates from engineering or law schools. Barbosa and Furtado, who took over the Ministry of Planning from João Goulart, are examples of ministers with legal educations and a more humanistic mindset. Trained in engineering, Gudin and Simonsen, on the other hand, “brought to the job a mathematical, precise way of thinking, typical of their area of expertise,” observes the historian. “In the historical series of finance ministers, there’s a clear dividing line in the 1960s,” points out Saes. From that time on, ministers trained as economists would hold sway, beginning with Delfim Netto, who was a member of the third class of economists to graduate from FEA-USP.

Republish