When Brazil became an independent nation, it had to confront one fundamental issue: where would the money to fund the state come from? It’s a difficult question, for any nation. Deciding who is to be taxed and by what means, then determining how the resulting funds will be spent is the subject of deep political disputes. In the case of a sparsely populated, slavery-based, nascent country, the problem is even more thorny, since the tax base is frequently narrow, while large expenses may have to be incurred. With the bicentennial of Brazilian Independence coming on September 7, the issue of fiscal order during imperial Brazil is the subject of several book launches. Three of these books start from the assumption that it’s impossible to understand the origin and nature of a state and a society, with its conflicts and power relations, without looking closely at its taxes and public expenditures.

In As finanças do Estado brasileiro (The finances of the Brazilian state) (1808–1898), historian Ângelo Alves Carrara, from the Federal University of Juiz de Fora (UFJF), shows how pressure from slave owners and traffickers and the crisis of the Cisplatine War (1825–1828) resulted in the tax system implemented in the 1830s. Based on a thesis presented to gain full professorship at his university, the book uses sources ranging from municipal council records and provincial reports to manuscripts kept in the Brazilian National Library and the collection of the Lisbon Academy of Sciences.

In Cidadãos e contribuintes: Estudos de história fiscal (Citizens and taxpayers: Studies in fiscal history), historian Wilma Peres Costa, from the Federal University of São Paulo (UNIFESP), focuses on “the enigma of the Empire,” bringing together empirical and theoretical studies conducted since the 1990s. In fact, her book discusses an array of enigmas, the first of which is how a fiscal state was established in Brazil, a country with a small free populace, when by definition the taxpayer—a citizen who earns income and pays taxes—is central to the constitution of the modern liberal state. The book received the Sergio Buarque de Holanda award from the Brazilian National Library in 2021.

Later this year, the Companhia das Letras publishing house will launch Adeus, Sr. Portugal – Uma história econômica da Independência (Goodbye, Mr. Portugal: An economic history of the Independence), by Thales Zamberlan Pereira, a professor at the School of Economics at Fundação Getulio Vargas in São Paulo (EESP-FGV) and journalist Rafael Cariello. The authors argue that the fiscal crisis of the Portuguese Crown is at the heart of the process that led to the Independence of Brazil in 1822, against the critical backdrop of Portugal’s military spending on the Napoleonic Wars and the spread of liberal and enlightenment thought that had already begun in the previous century. Pereira used econometric tools to interpret data he collected during two research stays in London, working from British consular reports on Brazil and information on the young nation’s foreign exchange market.

The Brazilian state obtained the better part of its tax revenues from customs tariffs

Crisis of absolutism

In the years leading up to Independence, Pereira says, “there was growing unease from subjects on both sides of the Atlantic who were opposed to absolutism. What the elites in Pernambuco, Bahia, Porto, and Lisbon wanted was to have some control over the income generated in their regions.” The crisis in Portuguese America occurred in parallel with the Liberal Revolution of 1820 in Portugal, which began with the uprising of merchants in the city of Porto, then spread to Lisbon, threatening the absolutist monarchy headed by Dom João VI (1767–1826). “The uprisings in Brazil weren’t simply a reflection of the Porto revolution. One important cause of the revolt was the fiscal crisis, which generated inflation here, a lack of payments there, and general dissatisfaction,” he explains.

The rebels’ principal demand was the adoption of a Constitution, which would mean the end of absolutism, a system in which the monarch holds unlimited power. Above all, Pereira points out, this meant limiting the king’s powers, particularly those of extracting wealth from the population. “The debates in Portuguese America were not about being independent from Portugal, but about imposing limits on the arbitrariness of the monarchy. Some regions of Brazil, such as Pernambuco, did not want to pay taxes to bankroll public lighting in Rio. They didn’t want to see their cotton exports increasingly being taxed to pay for wars in the southern part of the country,” the economist observes.

In 1821, constituent courts were implemented in Lisbon, which included representatives from Brazil. The process gave rise to power struggles. “The different parts of the Empire began to argue about where the taxes would come from, how they would be controlled and by whom, and where the revenues would be spent. There was a larger number of European representatives, and the representatives for the Americas quickly came to view the costs and benefits resulting from the charter being voted on in Lisbon to be unsatisfactory,” says Pereira.

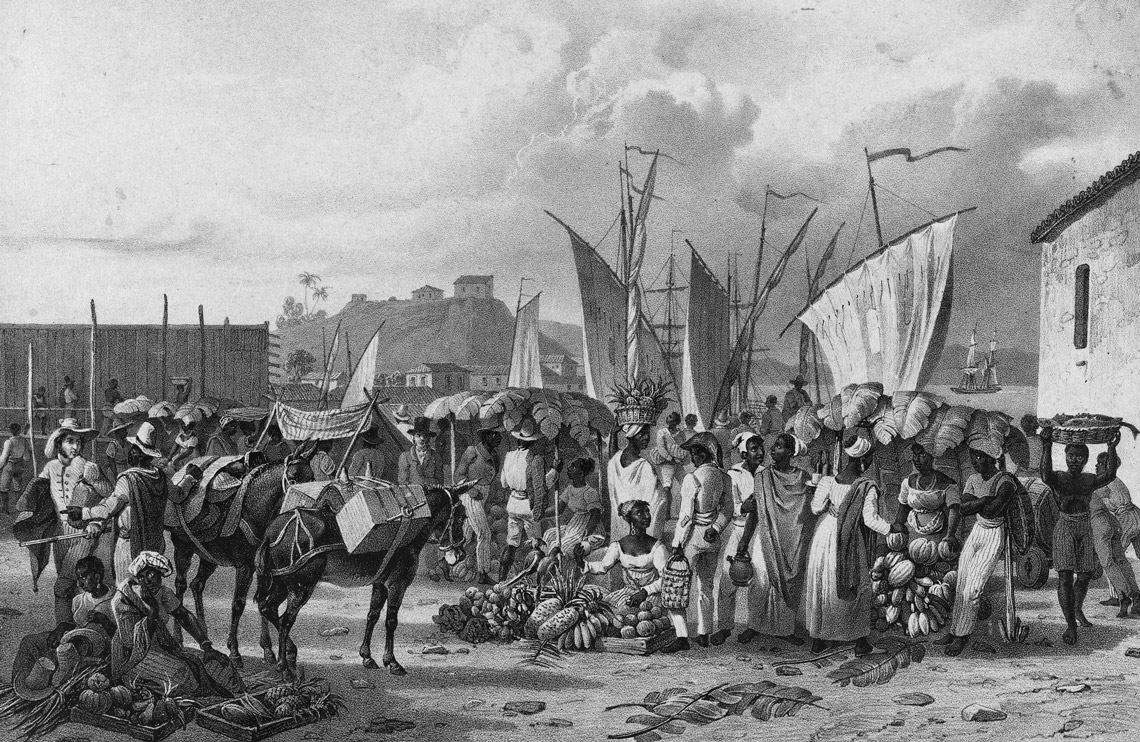

Meanwhile, on this side of the Atlantic, elites in wealthier provinces such as Bahia and Pernambuco stopped sending their customs revenues to the court in Rio de Janeiro, establishing local governmental bodies instead. The Portuguese majority in the Constituent Assembly wanted to eliminate the civil service jobs that had been created in Rio beginning in 1808, in addition to reducing direct trade between Brazil and other countries as much as possible, in order to recover the customs revenues lost in 1808 when Brazilian ports were opened to friendly nations.

Brazilian National Library

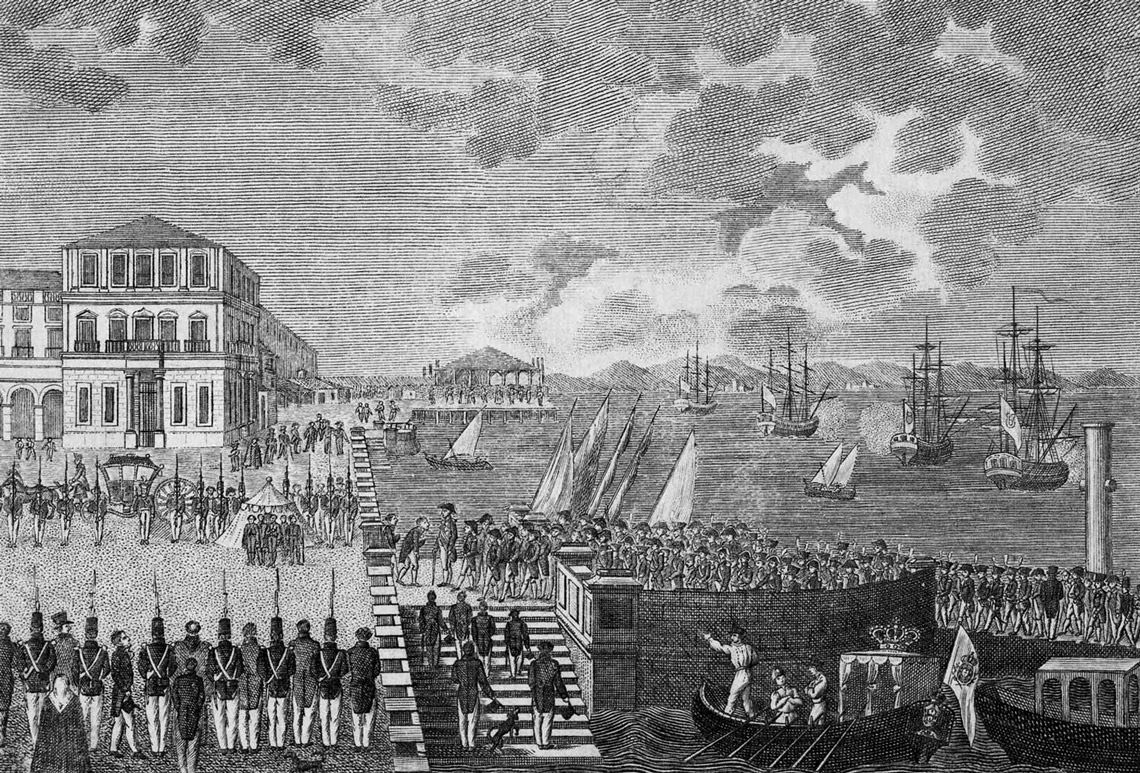

The return of Dom João VI to Portugal, in July 1821, as depicted by Constantino de FontesBrazilian National Library“Each discussion of administrative or commercial restructuring brought with it a fiscal consequence, impacting the division of powers within the United Kingdom of Portugal, Brazil, and the Algarves,” notes Pereira. There were conflicts not only between the Portuguese and their American colonies, but also between Brazilian provinces and the political center in Rio. During these disputes, the decisive event in achieving independence in 1822 was the proposal by Dom Pedro I (1798–1834), Portugal’s prince regent residing in Rio, to implement an exclusive constituent assembly for the provinces of Brazil. For the Portuguese in the Americas, breaking away from the European power centers would open the prospect of more autonomy to collect taxes and apportion spending.

Once the separation was formally established, it exposed a fiscal paradox in Brazil that would hang over the country’s financial and tax system at least until the Paraguayan War (1864–1870). On one hand, the young nation’s government needed to raise funds for current expenditures, investments, and debt repayment. On the other hand, large landowners and slaveholders controlled most of the wealth and resisted taxation as much as possible. The paradox lies in the fact that the political leaders who controlled the state that now intended to collect taxes were members of these same landowning classes, such that in effect they were trying to tax themselves and, at the same time, avoid their own revenue-collection efforts.

In Costa’s terms, the state’s “extractive drive” suffered major obstacles in Brazil, principal among these being this same ruling elite who controlled the nascent government. As plantation owners who were able to produce their exports thanks to the exploitation of enslaved labor, they remained opposed—throughout the entire nineteenth century—to the taxation of their wealth bases. In addition, there was the difficulty of instituting new forms of collection to replace the system of “contractors,” in which families had the right to collect taxes on behalf of the Portuguese Crown. This system had generated large fortunes among the colonists (such as the Silva Prado and Andradas families), but it also led to conflicts when these contractors had their interests thwarted. Such was the case with the Inconfidência Mineira (Minas Gerais Conspiracy) (1789–1792).

The main element of the impasse was the owning of slaves, since international trafficking had been banned in 1831 through an agreement with England. The interdiction did not, however, prevent around 800,000 more people from being brought to the country as captives by 1850. For that to occur, Costa observes, it was necessary for the young nation to develop a culture of informality and silence that compromised the normal progress of modernity, such as the registration of properties, the civil registry of the populace, and a revenue system based on taxing the production and circulation of goods.

Brazilian National Library

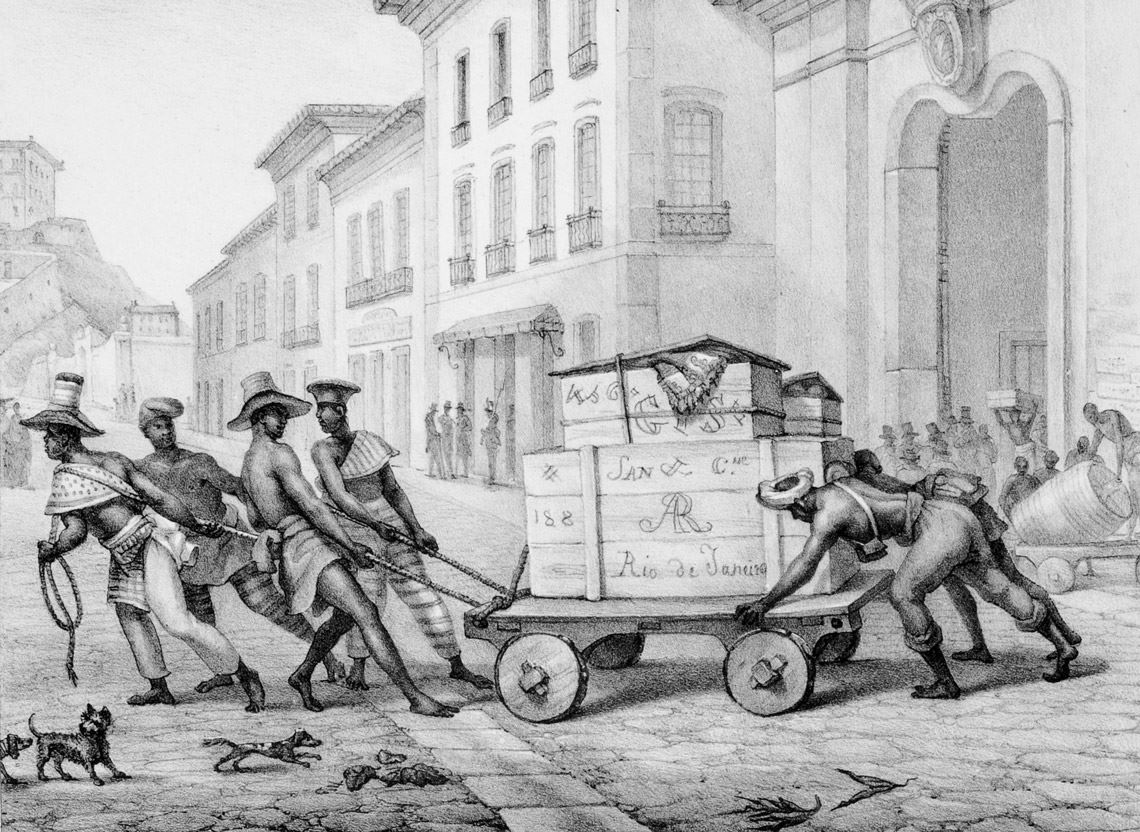

Slaves working at the customs square in 1860, in a scene by Luis SchlapprizBrazilian National Library“To a large extent, my studies are about things that didn’t happen. They trace a history of what did not occur, but for that very reason they’re significant. We’re talking about a state that spent two-thirds of a century trying to do a census, until it finally succeeded in 1872. They tried to implement the civil registry, impose the metric system, register land. These are projects that constantly faced seemingly insurmountable obstacles,” the historian observes.

The case of taxes is emblematic because land taxation is “a classic element of the liberal state, the foundation of revenue collecting in England and, later, the Americas,” he explains. Through property taxes, land became a commodity like any other. As a result, the expanding bourgeoisie could mortgage properties to gain access to credit, fostering economic growth. This is a central point in the emergence of European capitalism. “But in Brazil the two great foundations of the social order, large properties and slavery, are not subject to taxation. And it’s not because nobody had had this idea. On the contrary, there were many efforts, projects, land registrations that were never carried out, and laws that were voted on but never went into effect,” the researcher points out.

Costa adds that “there is a perverse aspect to the formation of our society.” On many occasions, the interests of the ruling class found an echo in the rest of the population, which also “ended up working against the construction of a public order,” she adds, citing the civil registry as an example. While the trafficking of enslaved people went on illegally in Brazil from 1831 to 1850, the landowners who employed the captives tried to avoid registering these individuals at all costs, so as not to provide evidence of their origins. The freed population (former slaves) also had little interest in being officially registered.

“These people were afraid of losing their positions, which were structured around this nongovernmental, extralegal order. Because declarations regarding the condition of slavery were made by the slaveowners, they feared being declared ‘captives’ and by such means being returned to slavery,” explains Costa. In 1851, the government enacted a regulation for the Registration of Births and Deaths in the Empire and a law that provided for a demographic census. The initiative led to an armed conflict the following year, known as the Levante dos Marimbondos (the Hornet Uprising), in the states of Pernambuco, Ceará, Rio Grande do Norte, and Alagoas. “The populace referred to the registration as the ‘slavery law,’ believing that the plantation owners would use it as a means of compensating for the end of slave trafficking, by revoking their freedom.” According to press reports at the time, in several cities in the Northeast, crowds gathered to tear down the official notifications regarding the civil registry and census from the doors of churches. The rebel groups’ buzzing was compared to a swarm of wasps, giving the revolt its name.

Brazilian National Library

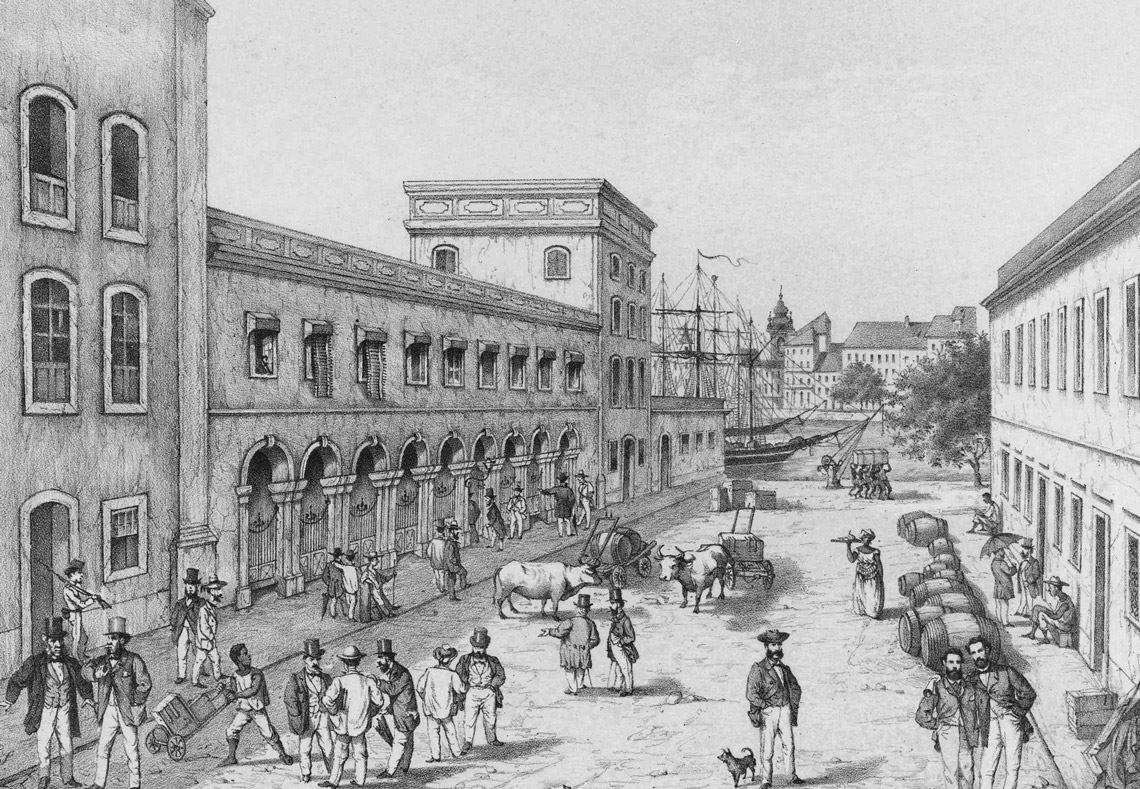

Negros de Carro, by Jean-Baptiste Debret (1835)Brazilian National LibraryUnable to tax property ownership and encountering great difficulty in collecting taxes such as the meia siza (the 5% levy on the sale of slaves), the Brazilian state obtained most of its revenue from customs tariffs. “About two-thirds—never less than 50%—of public revenue came from taxes on imports. This solution was cumbersome, because it burdened society as a whole; anyone buying a hat or a piano bore the cost of the state,” summarizes Carrara, from UFJF. “But it served the interests of the landowners, because there was zero tax on their income.”

This strategy came at a high price. “The state was at various times unable to cover its expenses. There was large, growing public debt, which accumulated until the moment came when the government was unable to pay any more,” the historian explains. Expenses such as expanding the rail network and port infrastructure, which benefited the agricultural-export sector, had been funded by increasing this indebtedness. With the debt came the issuance of low-value copper coins and inflation.

Carrara adds that from a fiscal point of view, there had already been a federate structure in Brazil since the colonial period, since each province was responsible for managing its own revenue collection and expenditures. The prerogatives of the three levels of government—the general (today, federal), the provincial (state) and the municipal—were defined in 1839 with Law No. 16, known as the Additional Act. The proportional rate at which each level collected taxes has remained fairly constant throughout history: the general government with about two-thirds of the revenues, the provinces with a quarter, and the municipalities with approximately 6%. “In the most recent data that I analyzed, from 2020, this distribution remains practically unchanged,” Carrara observes.

Within the Empire, the provinces had the right to levy taxes, as long as they didn’t overlap taxes from the central administration. The problem was that there were few options left, since they were unable to tax the land, nor those still enslaved, nor the entry of goods. Consumption was limited, and the income tax had not yet been created. Only a few provinces could afford to tax exports, namely those that dominated a quasi-monopolistic commodity across the global market, such as coffee, and, for a brief period, Amazonian rubber.

The change of regime did not bring significant change to the problems of taxation. “The Republic gave greater powers to the states, but that doesn’t do much good if they don’t have the conditions to exercise those powers,” summarizes Costa, from UNIFESP. “For many territorial units in the federation, federalism was a ruse. Decentralization was like a magic word, but what actually happened was that the poorer states remained poor and the rich states became much richer.”

Scientific article

PEREIRA, T. Z. Taxation and the stagnation of cotton exports in Brazil, 1800-60. Economic History Review. vol. 74, no. 2, pp. 522–45. 2021.

Books

Carrara, A. A. As finanças do Estado brasileiro. 1808–1898. Belo Horizonte: Fino Traço, 2022.

Costa, W. P. Cidadãos & contribuintes. Estudos de história fiscal. São Paulo: Alameda, 2000.