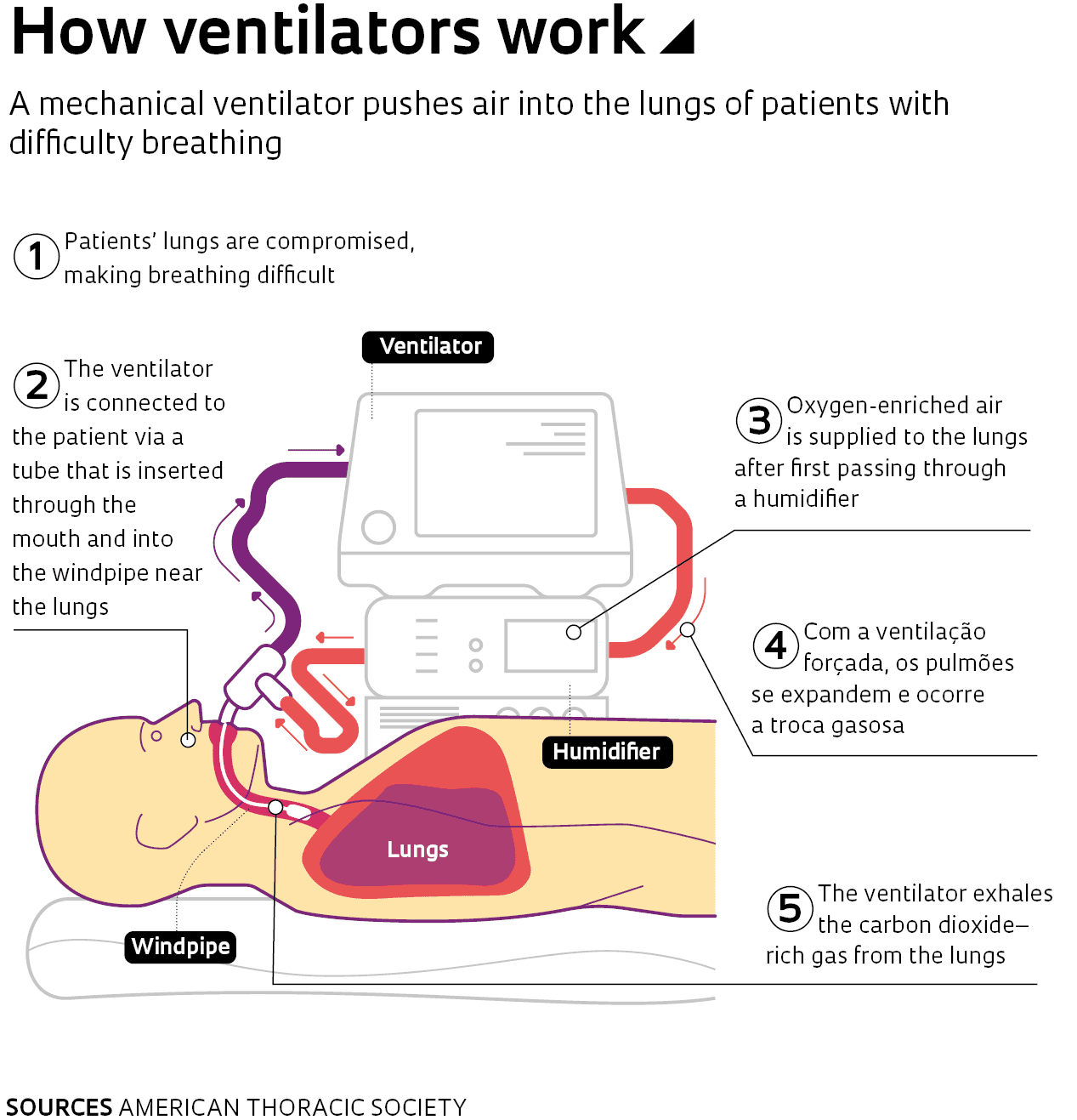

A shortage of ventilators has been one of the biggest constraints in treating patients with severe cases of COVID-19. Soon after the pandemic started, governments, hospitals, and physicians began to take stock of where and how many units were available. Machines to help people breathe are essential in treating patients with acute respiratory distress syndrome (ARDS), a severe outcome of COVID-19. Virtually all patients admitted to intensive care units (ICUs) with the severe form of the disease require ventilation, as they are unable to breathe adequately on their own.

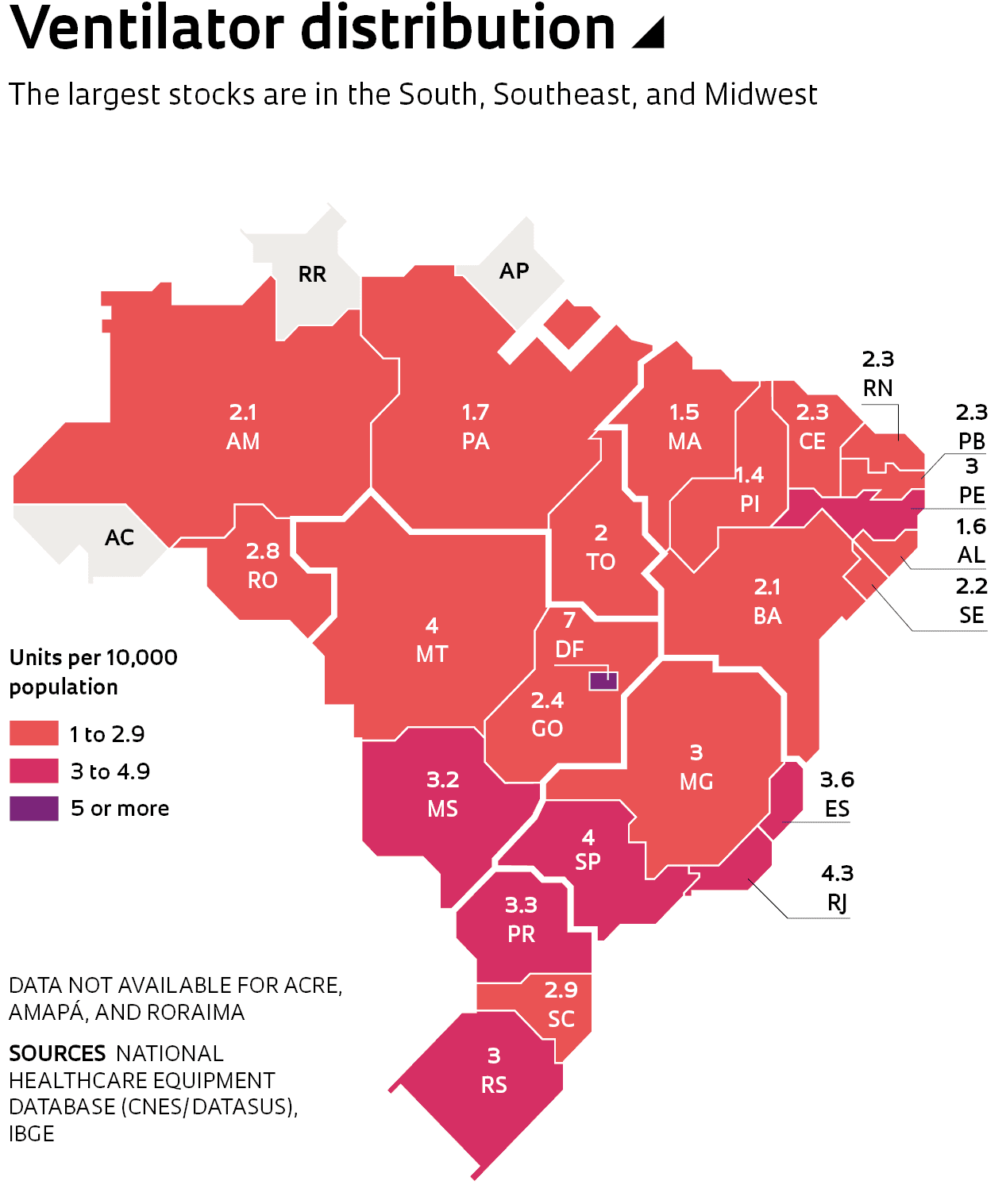

Experts estimate that the current supply of ventilators will be insufficient to meet potential demand in Brazil, prompting the Federal and state governments to launch efforts to build a stockpile of the vital machines. There were 68,044 ventilators in the country as of April 24 according to data from the Brazilian Ministry of Health’s National Health Equipment Database (CNES), a list of equipment available at public and private healthcare providers. Of the total stock of ventilators, 49,196 are at National Healthcare System (SUS) hospitals, and the remainder in the private sector (see infographic). This includes infant ventilators and equipment under maintenance.

– Science fights back

– A frightening disease

– The antivirus arsenal

– Progress toward dengue vaccine

– In the palm of the hand

– Michel Nussenzweig: Antibody hunter

– Historical vulnerability

According to estimates, Brazil will need an additional 20,000 ventilators for the pandemic. To meet this demand, the Ministry of Health has signed contracts with three Brazilian manufacturers to procure a total of 14,100 ventilators. The largest order, for 6,500 ventilators, was awarded to Magnamed, a company based in Cotia, greater São Paulo. Another 4,300 units have been ordered from Intermed and 3,300 from KTK, both in São Paulo.

Magnamed, a company created with support from FAPESP’s Research for Innovation in Small Businesses (RISB, or PIPE in the Portuguese acronym) program, formed a collaboration with a group of corporates—Positivo Tecnologia, Suzano, Klabin, Flex, and Embraer—to fulfill the R$322.5 million order from the Ministry of Health. The first ventilators have already been delivered and the remainder are expected to be ready by August. “Magnamed is honored to be of help to our country in this time of need, with the vital support of partners,” said Magnamed CEO Wataru Ueda in a press statement.

Support network

Under the collaboration arrangement, Positivo is providing control electronics for the ventilators, and Suzano has procured suppliers and provided working capital to purchase components. Klabin has managed procurement and imports of ventilator parts, as well as providing packaging for shipping the equipment to hospitals. Embraer, with its expertise in complex machining, has advised Magnamed on scaling up production in a short space of time. The 6,500 ventilators are being built at a facility in Sorocaba, São Paulo State, owned by Flextronics, which produces electronics on demand for partner companies, including some in the healthcare industry.

Magnamed produces 1,800 ventilators per year, of which 40% are supplied to ICUs. The company exports its product range—comprising four ventilator models and a gas-flow analyzer—to 60 countries, generating 40% of its revenues abroad. According to the report “2020 Global ICU Ventilator Market Outlook,” Magnamed is now a leading player in the global ventilator market, alongside global giants such as Philips and GE.

The Ministry of Health ordered two of the company’s ventilator models: FlexiMag Plus, for ICUs; and OxyMag, an emergency transport ventilator. FAPESP supplied funding for the development of OxyMag, FlexMag—an earlier version of the FlexiMag Plus—and a gas-mixing module. The first grant was awarded in 2005, the year the company was founded.

“FAPESP funding was pivotal for our development,” Ueda told Pesquisa FAPESP. “The support we received from FINEP [the Brazilian Funding Authority for Studies and Projects], CNPq [the Brazilian National Council for Scientific and Technological Development], and CIETEC [Center for Innovation, Entrepreneurship, and Technology] was equally crucial. And as important as the financial support was the opportunity for knowledge exchange. All of this played a role in our growth, with the company making the list of Brazil’s fastest-growing small and medium-sized businesses in 2017.” The list is published by weekly business magazine Exame.

Magnamed was founded 15 years ago by electronic engineer Wataru Ueda, a graduate from the Brazilian Air Force Institute of Technology (ITA), and two colleagues: mechanical engineer Tatsuo Suzuki, a fellow ITA alumnus; and electrical engineer Toru Kinjo, who graduated from the Polytechnic School at the University of São Paulo (POLI-USP). Magnamed was initially based out of Ueda’s mother’s garage, for six months. “In 2006 our project was selected for incubation at CIETEC,” Ueda said in a 2017 interview with Pesquisa FAPESP (see issue no. 259). “There, we conducted product research and development, and put our business plan into practice. We spent two years in incubation.”

Léo Ramos Chaves

The ventilator production line at Magnamed in São PauloLéo Ramos ChavesA financial injection

In 2008 Magnamed received funding from seed capital fund CRIATEC of the Brazilian Development Bank (BNDES)—a total of R$5 million during the company’s early years. “This funding provided a needed injection of cash at a time when we were running out of funds to continue developing products,” says Ueda. Development of the first OxyMag version was completed in 2008. The model was launched in 2011, followed by FlexiMag in 2013.

Two years later, Magnamed received additional investment from venture capital company Vox Capital toward the development of two additional ventilator models. In 2016, a year of rapid expansion, the company was selected as the official supplier of emergency ventilation equipment to the Summer Olympics in Rio de Janeiro.

Adding to the three firms selected by the Ministry of Health is a fourth local ventilator manufacturer, Leistung, in Santa Catarina, southern Brazil. In late March, the company concluded a technology transfer agreement with WEG, a company specializing in industrial motors, generators and automation equipment (see Pesquisa FAPESP issue no. 279), to expand its production capacity.

The contract gives WEG a license to produce Leistung’s Luft-3 ventilator model for ICUs. WEG has retooled its manufacturing facilities in Jaraguá do Sul (SC) to produce ventilators and expects to complete the first deliveries in the second half of May. The assembly line will have an estimated capacity to produce 50 units per day, WEG said in a press release.

Paulo Henrique Fraccaro, chairman of the Brazilian Association of Medical, Dental, Hospital, and Laboratory Equipment Manufacturers (ABIMO), notes that at the onset of the pandemic, Brazilian firms accounted for 50% to 60% of ventilators supplied to the local market. The remainder were imported from multinationals and distributors such as GE, Philips, Drager, Maquet, Hamilton, Resmed, Mindray, and Medtronic. But with the increase in global demand, equipment costs rose precipitously as foreign-made ventilators went into short supply and became prohibitively expensive.

“Ventilator prices went from US$8,000 to approximately US$25,000 to US$30,000,” says Fraccaro. “A Brazilian hospital requiring ventilators will likely have to source them from the international market.” Combined with the higher demand, a strong US dollar drove up the costs of ventilator components, some of which are imported.

Academia joins the effort

Alongside local ventilator manufacturers, researchers from across Brazil have also mobilized to develop and produce ventilators as quickly as possible and at low cost. Electrical engineer Jurandir Nadal, who heads the Pulmonary and Cardiovascular Engineering Laboratory run by the Biomedical Engineering Program at the Alberto Luiz Coimbra Institute of Engineering Research and Graduate Studies, of the Federal University of Rio de Janeiro (COPPE-UFRJ), launched a call for volunteers on Facebook in March to develop a low-complexity ventilator at less than current costs. Petrobras provided the project team with technical consulting and access to 3D printers at its research center.

At POLI-USP, a group of researchers led by engineers Raul Gonzalez Lima and Marcelo Zuffo has successfully developed a low-cost ventilator of their own in a concurrent project. The team has requested permission from the Brazilian Health Regulatory Agency (ANVISA) to produce it for hospital use. They plan to source most parts from local manufacturers to fast-track production and lower the final cost of the ventilator, which they estimate will be around R$1,000 per unit. The ventilator design will be licensed to nonmedical companies for production.

In partnership with FINEP, FAPESP launched a call for proposals to support the COVID-19 response through innovation across several fronts, including ventilators. The RISB program will also support related research projects at startups and small businesses in São Paulo (further information can be found at www.fapesp.br/14087).

In Rio Grande do Sul, a team at a hospital in Greater Porto Alegre has tested a method that allows two to four patients to be ventilated simultaneously from the same unit. “Both patients need to have similar breathing patterns so they can use the same ventilator settings, as if they were a single patient,” physician Emmanuel Rath Bonazina told online news site G1-RS.

Split ventilation has been adopted in New York—the US epicenter of the coronavirus pandemic—and in Italy, which faced a severe shortage of the machines. Specialists, however, have raised concerns about the potential problems that could stem from ventilators being split between patients with different lung capacities and needs. In addition to making it difficult to monitor ventilation outcomes for each patient, dual-patient ventilation also creates a risk of cross-contamination with pathogens.

Mechanical engineer Marcelo Naoki Onodera, who has been involved in ventilator research, development, and production for more than 10 years, says the ventilators currently available on the market offer a wide range of functionality and are not easy to reproduce. “Today’s ventilators are microprocessor-based and highly sophisticated,” says the specialist, describing the array of sensors, alarms, valves, and other functionality in a modern ventilator. “Building a ventilator is not a simple task.”

Onodera also notes that critical components such as the air valves used to control airflow, and pressure, flow, and oxygen concentration sensors, are typically imported. Large manufacturers, such as US-based Parker, supply these components to ventilator manufacturers around the world. “I spoke to an engineer at Parker who told me that these valves are now out of stock even in the US,” says Onodera. “This will constrain production.”

Some of the equipment that is being produced on demand in Brazil is similar to a model used around 60 years ago, says Onodera. “This is a well-known model, the 600 series, developed by Brazilian anesthesiologist Kentaro Takaoka in the 1950s,” he says (see article). “This mechanical ventilator is connected to the hospital’s oxygen supply system; it has no electronics and instead uses a system of springs and magnets.” He believes under normal conditions this model would likely not obtain ANVISA approval. In the current crisis, however, Onodera says it can still help to save lives.

Ventilator support falls under two major categories: invasive and noninvasive ventilation. According to physiotherapist Camila Cestaro de Almeida, most COVID-19 cases have received invasive ventilation, in which an endotracheal tube is placed into the windpipe through the mouth (see infographic). Noninvasive ventilation is done using a face mask.